Forward derivatives, also known as “forward contracts” or “forwards,” are a type of financial instrument used to hedge risk, speculate on price movements, or lock in future prices for assets. These derivatives are private agreements between two parties to buy or sell an asset at a predetermined price on a specified future date.

Here’s a detailed breakdown of forward derivatives:

A forward contract is an agreement between two parties (usually referred to as the “buyer” and the “seller”) to exchange an asset for a specific price at a future date. The contract can be made for various types of underlying assets, such as commodities (oil, gold), currencies, interest rates, or even stock indices.

The forward price is the agreed-upon price for the asset in the contract. It is determined based on the spot price of the underlying asset (the current market price) and factors such as the time until the contract’s expiration, interest rates, and any storage or carrying costs (for physical assets like commodities).

The forward price can be determined using the following formula:

Where:

Let’s say an investor wants to lock in the price of gold, which is currently trading at $1,800 per ounce, for a future date of six months from now. The investor enters into a forward contract with a counterparty (a bank or another investor) to buy 100 ounces of gold at a price of $1,800 per ounce in six months.

Forward contracts are used in various sectors, including:

While forward contracts and futures contracts are similar, they have some key differences:

Forward derivatives are valuable financial instruments used to manage risk, lock in prices, or speculate on price changes. They offer flexibility in terms of contract specifications but also come with increased risks, such as counterparty risk and lack of liquidity. While they are widely used in various industries, understanding the mechanics and risks of forwards is essential for anyone involved in their use.

| Exchange | Issuer | Asset Class | Code | Fund Name |

|---|---|---|---|---|

| ASX | Airlie Funds Management | Australian Shares | AASF | Airlie Australian Share Fund |

| ASX | Apostle | ADEF | Apostle Dundas Global Equity Fund - Class D Units (Managed Fund) | |

| ASX | BetaShares | Active | BNDS | Western Asset Australian Bond Fund (Managed Fund) |

| ASX | BetaShares | Active | EINC | Martin Currie Equity Income Fund (Managed Fund) |

| ASX | BetaShares | Active | EMMG | Martin Currie Emerging Markets Fund (Managed Fund) |

| ASX | BetaShares | Active | HBRD | Active Australian Hybrids Fund |

| ASX | BetaShares | Active | RINC | Martin Currie Real Income Fund (Managed Fund) |

| ASX | BetaShares | Australian Shares | A200 | Australia 200 ETF |

| ASX | BetaShares | Australian Shares | AQLT | Australian Quality ETF |

| ASX | BetaShares | Australian Shares | ATEC | S&P/ASX Australian Technology ETF |

| ASX | BetaShares | Australian Shares | AUST | Managed Risk Australian Share Fund (Managed Fund) |

| ASX | BetaShares | Australian Shares | BBOZ | Australian Equities Strong Bear Hedge Fund |

| ASX | BetaShares | Australian Shares | BEAR | Australian Equities Bear Hedge Fund |

| ASX | BetaShares | Australian Shares | EINC | Martin Currie Equity Income Fund (Managed Fund) |

| ASX | BetaShares | Australian Shares | EX20 | Australian Ex-20 Portfolio Diversifier ETF |

| ASX | BetaShares | Australian Shares | FAIR | Australian Sustainability Leaders ETF |

| ASX | BetaShares | Australian Shares | GEAR | Geared Australian Equity Fund (Hedge Fund) |

| ASX | BetaShares | Australian Shares | HVST | Australian Dividend Harvester Fund (Managed Fund) |

| ASX | BetaShares | Australian Shares | QFN | Australian Financials Sector ETF |

| ASX | BetaShares | Australian Shares | QOZ | FTSE RAFI Australia 200 ETF |

| ASX | BetaShares | Australian Shares | QRE | Australian Resources Sector ETF |

| ASX | BetaShares | Australian Shares | RINC | Martin Currie Real Income Fund (Managed Fund) |

| ASX | BetaShares | Australian Shares | SMLL | Australian Small Companies Select Fund (Managed Fund) |

| ASX | BetaShares | Australian Shares | YMAX | Australian Top 20 Equity Yield Maximiser Fund (Managed Fund) |

| ASX | BetaShares | Cash & Fixed Income | AAA | Australian High Interest Cash ETF |

| ASX | BetaShares | Cash & Fixed Income | AGVT | Australian Government Bond ETF |

| ASX | BetaShares | Cash & Fixed Income | BNDS | Western Asset Australian Bond Fund (Managed Fund) |

| ASX | BetaShares | Cash & Fixed Income | CRED | Australian Investment Grade Corporate Bond ETF |

| ASX | BetaShares | Cash & Fixed Income | GBND | Sustainability Leaders Diversified Bond ETF - Currency Hedged |

| ASX | BetaShares | Cash & Fixed Income | GGOV | Global Government Bond 20+ Year ETF - Currency Hedged |

| ASX | BetaShares | Cash & Fixed Income | OZBD | Australian Composite Bond ETF |

| ASX | BetaShares | Cash & Fixed Income | QPON | Australian Bank Senior Floating Rate Bond ETF |

| ASX | BetaShares | Commodities | OOO | Crude Oil Index ETF - Currency Hedged (Synthetic) |

| ASX | BetaShares | Commodities | QAU | Gold Bullion ETF - Currency Hedged |

| ASX | BetaShares | Currency | AUDS | Strong Australian Dollar Fund (Hedge Fund) |

| ASX | BetaShares | Currency | EEU | Euro ETF |

| ASX | BetaShares | Currency | POU | British Pound ETF |

| ASX | BetaShares | Currency | USD | U.S. Dollar ETF |

| ASX | BetaShares | Currency | YANK | Strong U.S. Dollar Fund (Hedge Fund) |

| ASX | BetaShares | Digital Assets | CRYP | Crypto Innovators ETF |

| ASX | BetaShares | Diversified | DBBF | Ethical Diversified Balanced ETF |

| ASX | BetaShares | Diversified | DGGF | Ethical Diversified Growth ETF |

| ASX | BetaShares | Diversified | DHHF | Diversified All Growth ETF |

| ASX | BetaShares | Diversified | DZZF | Ethical Diversified High Growth ETF |

| ASX | BetaShares | Equity Income | EINC | Martin Currie Equity Income Fund (Managed Fund) |

| ASX | BetaShares | Equity Income | HVST | Australian Dividend Harvester Fund (Managed Fund) |

| ASX | BetaShares | Equity Income | INCM | Global Income Leaders ETF |

| ASX | BetaShares | Equity Income | RINC | Martin Currie Real Income Fund (Managed Fund) |

| ASX | BetaShares | Equity Income | UMAX | S&P 500 Yield Maximiser Fund (Managed Fund) |

| ASX | BetaShares | Equity Income | YMAX | Australian Top 20 Equity Yield Maximiser Fund (Managed Fund) |

| ASX | BetaShares | Ethical | DBBF | Ethical Diversified Balanced ETF |

| ASX | BetaShares | Ethical | DGGF | Ethical Diversified Growth ETF |

| ASX | BetaShares | Ethical | DZZF | Ethical Diversified High Growth ETF |

| ASX | BetaShares | Ethical | ERTH | Climate Change Innovation ETF |

| ASX | BetaShares | Ethical | ETHI | Global Sustainability Leaders ETF |

| ASX | BetaShares | Ethical | FAIR | Australian Sustainability Leaders ETF |

| ASX | BetaShares | Ethical | GBND | Sustainability Leaders Diversified Bond ETF - Currency Hedged |

| ASX | BetaShares | Ethical | HETH | Global Sustainability Leaders ETF - Currency Hedged |

| ASX | BetaShares | Global Sectors | BNKS | Global Banks ETF - Currency Hedged |

| ASX | BetaShares | Global Sectors | DRUG | Global Healthcare ETF - Currency Hedged |

| ASX | BetaShares | Global Sectors | FUEL | Global Energy Companies ETF - Currency Hedged |

| ASX | BetaShares | Global Sectors | MNRS | Global Gold Miners ETF - Currency Hedged |

| ASX | BetaShares | Hybrids | BHYB | Australian Major Bank Hybrids Index ETF |

| ASX | BetaShares | Hybrids | HBRD | Active Australian Hybrids Fund |

| ASX | BetaShares | International Shares | ASIA | Asia Technology Tigers ETF |

| ASX | BetaShares | International Shares | BBUS | U.S. Equities Strong Bear Hedge Fund - Currency Hedged |

| ASX | BetaShares | International Shares | BNKS | Global Banks ETF - Currency Hedged |

| ASX | BetaShares | International Shares | CLDD | Cloud Computing ETF |

| ASX | BetaShares | International Shares | DRUG | Global Healthcare ETF - Currency Hedged |

| ASX | BetaShares | International Shares | EDOC | Digital Health and Telemedicine ETF |

| ASX | BetaShares | International Shares | EMMG | Martin Currie Emerging Markets Fund (Managed Fund) |

| ASX | BetaShares | International Shares | ERTH | Climate Change Innovation ETF |

| ASX | BetaShares | International Shares | ETHI | Global Sustainability Leaders ETF |

| ASX | BetaShares | International Shares | F100 | FTSE 100 ETF |

| ASX | BetaShares | International Shares | FOOD | Global Agriculture Companies ETF - Currency Hedged |

| ASX | BetaShares | International Shares | FUEL | Global Energy Companies ETF - Currency Hedged |

| ASX | BetaShares | International Shares | GGUS | Geared U.S. Equity Fund - Currency Hedged (Hedge Fund) |

| ASX | BetaShares | International Shares | HACK | Global Cybersecurity ETF |

| ASX | BetaShares | International Shares | HETH | Global Sustainability Leaders ETF - Currency Hedged |

| ASX | BetaShares | International Shares | HEUR | Europe ETF - Currency Hedged |

| ASX | BetaShares | International Shares | HJPN | Japan ETF - Currency Hedged |

| ASX | BetaShares | International Shares | HNDQ | NASDAQ 100 ETF - Currency Hedged |

| ASX | BetaShares | International Shares | HQLT | Global Quality Leaders ETF - Currency Hedged |

| ASX | BetaShares | International Shares | IIND | India Quality ETF |

| ASX | BetaShares | International Shares | INCM | Global Income Leaders ETF |

| ASX | BetaShares | International Shares | MNRS | Global Gold Miners ETF - Currency Hedged |

| ASX | BetaShares | International Shares | NDQ | NASDAQ 100 ETF |

| ASX | BetaShares | International Shares | QLTY | Global Quality Leaders ETF |

| ASX | BetaShares | International Shares | QUS | S&P 500 Equal Weight ETF |

| ASX | BetaShares | International Shares | RBTZ | Global Robotics and Artificial Intelligence ETF |

| ASX | BetaShares | International Shares | UMAX | S&P 500 Yield Maximiser Fund (Managed Fund) |

| ASX | BetaShares | International Shares | WRLD | Managed Risk Global Share Fund (Managed Fund) |

| ASX | BetaShares | Managed Risk | AUST | Managed Risk Australian Share Fund (Managed Fund) |

| ASX | BetaShares | Managed Risk | HVST | Australian Dividend Harvester Fund (Managed Fund) |

| ASX | BetaShares | Managed Risk | WRLD | Managed Risk Global Share Fund (Managed Fund) |

| ASX | BetaShares | Property | RINC | Martin Currie Real Income Fund (Managed Fund) |

| ASX | BetaShares | Short & Geared | AUDS | Strong Australian Dollar Fund (Hedge Fund) |

| ASX | BetaShares | Short & Geared | BBOZ | Australian Equities Strong Bear Hedge Fund |

| ASX | BetaShares | Short & Geared | BBUS | U.S. Equities Strong Bear Hedge Fund - Currency Hedged |

| ASX | BetaShares | Short & Geared | BEAR | Australian Equities Bear Hedge Fund |

| ASX | BetaShares | Short & Geared | GEAR | Geared Australian Equity Fund (Hedge Fund) |

| ASX | BetaShares | Short & Geared | GGUS | Geared U.S. Equity Fund - Currency Hedged (Hedge Fund) |

| ASX | BetaShares | Short & Geared | YANK | Strong U.S. Dollar Fund (Hedge Fund) |

| ASX | BetaShares | Technology | ASIA | Asia Technology Tigers ETF |

| ASX | BetaShares | Technology | ATEC | S&P/ASX Australian Technology ETF |

| ASX | BetaShares | Technology | CLDD | Cloud Computing ETF |

| ASX | BetaShares | Technology | DRIV | Electric Vehicles and Future Mobility ETF |

| ASX | BetaShares | Technology | GAME | Video Games and Esports ETF |

| ASX | BetaShares | Technology | HACK | Global Cybersecurity ETF |

| ASX | BetaShares | Technology | HNDQ | NASDAQ 100 ETF - Currency Hedged |

| ASX | BetaShares | Technology | IBUY | Online Retail and E-Commerce ETF |

| ASX | BetaShares | Technology | IPAY | Future of Payments ETF |

| ASX | BetaShares | Technology | NDQ | NASDAQ 100 ETF |

| ASX | BetaShares | Technology | RBTZ | Global Robotics and Artificial Intelligence ETF |

| ASX | BetaShares | Thematic | ASIA | Asia Technology Tigers ETF |

| ASX | BetaShares | Thematic | ATEC | S&P/ASX Australian Technology ETF |

| ASX | BetaShares | Thematic | CLDD | Cloud Computing ETF |

| ASX | BetaShares | Thematic | CRYP | Crypto Innovators ETF |

| ASX | BetaShares | Thematic | DRIV | Electric Vehicles and Future Mobility ETF |

| ASX | BetaShares | Thematic | EDOC | Digital Health and Telemedicine ETF |

| ASX | BetaShares | Thematic | ERTH | Climate Change Innovation ETF |

| ASX | BetaShares | Thematic | GAME | Video Games and Esports ETF |

| ASX | BetaShares | Thematic | HACK | Global Cybersecurity ETF |

| ASX | BetaShares | Thematic | IBUY | Online Retail and E-Commerce ETF |

| ASX | BetaShares | Thematic | IPAY | Future of Payments ETF |

| ASX | BetaShares | Thematic | RBTZ | Global Robotics and Artificial Intelligence ETF |

| ASX | BlackRock (iShares) | Cash | BILL | Core Cash ETF |

| ASX | BlackRock (iShares) | Cash | ISEC | Enhanced Cash ETF |

| ASX | BlackRock (iShares) | Commodities | GLDN | iShares Physical Gold ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | AUMF | Edge MSCI Australia Multifactor ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | GLIN | iShares Core FTSE Global Infrastructure (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | IHD | S&P/ASX Dividend Opportunities ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | IHWL | Core MSCI World ex Australia ESG Leaders (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | ITEK | iShares Future Tech Innovators ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | IWLD | iShares Core MSCI World ex Australia ESG Leaders ETF |

| ASX | BlackRock (iShares) | Equity - All Cap | MVOL | Edge MSCI Australia Minimum Volatility ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IEM | MSCI Emerging Markets ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IEU | Europe ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IJP | MSCI Japan ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IKO | MSCI South Korea ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IVE | MSCI EAFE ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IVV | S&P 500 ETF |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IXI | Global Consumer Staples ETF (AU) |

| ASX | BlackRock (iShares) | Equity - Large / Mid Cap | IXJ | Global Healthcare ETF (AU) |

| ASX | BlackRock (iShares) | Equity - Large Cap | IAA | Asia 50 ETF (AU) |

| ASX | BlackRock (iShares) | Equity - Large Cap | IESG | Core MSCI Australia ESG Leaders ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | IHOO | Global 100 (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | IHVV | iShares S&P 500 (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | ILC | S&P/ASX 20 ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | IOO | Global 100 ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | IOZ | Core S&P/ASX 200 ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | IZZ | China Large-Cap ETF (AU) |

| ASX | BlackRock (iShares) | Equity - Large Cap | WDMF | Edge MSCI World Multifactor ETF |

| ASX | BlackRock (iShares) | Equity - Large Cap | WVOL | Edge MSCI World Minimum Volatility ETF |

| ASX | BlackRock (iShares) | Equity - Mid Cap | IJH | S&P Mid-Cap ETF |

| ASX | BlackRock (iShares) | Equity - Small Cap | IJR | S&P Small-Cap ETF |

| ASX | BlackRock (iShares) | Equity - Small Cap | ISO | S&P/ASX Small Ordinaries ETF |

| ASX | BlackRock (iShares) | Fixed Income - Credit | AESG | iShares Global Aggregate Bond ESG (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Fixed Income - Credit | ICOR | Core Corporate Bond ETF |

| ASX | BlackRock (iShares) | Fixed Income - Credit | IHCB | Core Global Corporate Bond (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Fixed Income - Credit | IYLD | Yield Plus ETF |

| ASX | BlackRock (iShares) | Fixed Income - Government | IGB | Treasury ETF |

| ASX | BlackRock (iShares) | Fixed Income - Government | IHEB | J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Fixed Income - Government | IUSG | iShares U.S. Treasury Bond (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Fixed Income - High Yield | IHHY | Global High Yield Bond (AUD Hedged) ETF |

| ASX | BlackRock (iShares) | Fixed Income - Inflation | ILB | Government Inflation ETF |

| ASX | BlackRock (iShares) | Fixed Income - Multi Sectors | IAF | Core Composite Bond ETF |

| ASX | BlackRock (iShares) | Multi Asset - Multi Strategy | IBAL | iShares Balanced ESG ETF |

| ASX | BlackRock (iShares) | Multi Asset - Multi Strategy | IGRO | iShares High Growth ESG ETF |

| ASX | BlackRock (iShares) | Real Estate - Real Estate Securities | GLPR | iShares Core FTSE Global Property Ex Australia (AUD Hedged) ETF |

| ASX | Daintree | DHOF | Daintree Hybrid Opportinities Fund | |

| ASX | Fidelity | FDEM | Global Demographics Fund (Managed Fund) | |

| ASX | Global X ETFs | Commodities | ATOM | Uranium ETF |

| ASX | Global X ETFs | Commodities | BCOM | Bloomberg Commodity ETF (Synthetic) |

| ASX | Global X ETFs | Commodities | ETPMAG | Physical Silver |

| ASX | Global X ETFs | Commodities | ETPMPD | Physical Palladium |

| ASX | Global X ETFs | Commodities | ETPMPM | Physical Precious Metals Basket |

| ASX | Global X ETFs | Commodities | ETPMPT | Physical Platinum |

| ASX | Global X ETFs | Commodities | GCO2 | Global Carbon ETF (Synthetic) |

| ASX | Global X ETFs | Commodities | GMTL | Green Metal Miners ETF |

| ASX | Global X ETFs | Commodities | GOLD | Physical Gold |

| ASX | Global X ETFs | Commodities | WIRE | Copper Miners ETF |

| ASX | Global X ETFs | Core | N100 | US 100 ETF |

| ASX | Global X ETFs | Core | OZXX | Australia ex Financials & Resources ETF |

| ASX | Global X ETFs | Digital Assets | EBTC | 21Shares Bitcoin ETF |

| ASX | Global X ETFs | Digital Assets | EETH | 21Shares Ethereum ETF |

| ASX | Global X ETFs | Income | AYLD | S&P/ASX 200 Covered Call ETF |

| ASX | Global X ETFs | Income | QYLD | Nasdaq 100 Covered Call ETF |

| ASX | Global X ETFs | Income | USHY | USD High Yield Bond ETF (Currency Hedged) |

| ASX | Global X ETFs | Income | USIG | USD Corporate Bond ETF (Currency Hedged) |

| ASX | Global X ETFs | Income | USTB | US Treasury Bond ETF (Currency Hedged) |

| ASX | Global X ETFs | Income | UYLD | S&P 500 Covered Call ETF |

| ASX | Global X ETFs | Income | ZYAU | S&P/ASX 200 High Dividend ETF |

| ASX | Global X ETFs | Income | ZYUS | S&P 500 High Yield Low Volatility ETF |

| ASX | Global X ETFs | International | ESTX | EURO STOXX 50 ETF |

| ASX | Global X ETFs | International | NDIA | India Nifty 50 ETF |

| ASX | Global X ETFs | Leveraged & Inverse | LNAS | Ultra Long Nasdaq 100 Hedge Fund |

| ASX | Global X ETFs | Leveraged & Inverse | SNAS | Ultra Short Nasdaq 100 Hedge Fund |

| ASX | Global X ETFs | Thematic | ACDC | Battery Tech & Lithium ETF |

| ASX | Global X ETFs | Thematic | BUGG | Cybersecurity ETF |

| ASX | Global X ETFs | Thematic | CURE | S&P Biotech ETF |

| ASX | Global X ETFs | Thematic | FANG | FANG+ ETF |

| ASX | Global X ETFs | Thematic | FTEC | Fintech & Blockchain ETF |

| ASX | Global X ETFs | Thematic | HGEN | Hydrogen ETF |

| ASX | Global X ETFs | Thematic | ROBO | ROBO Global Robotics & Automation ETF |

| ASX | Global X ETFs | Thematic | SEMI | Semiconductor ETF |

| ASX | Global X ETFs | Thematic | TECH | Morningstar Global Technology ETF |

| ASX | Hyperion | HYN04 | Hyperion Global Growth Companies Fund (Managed Fund) | |

| ASX | Janus Henderson | FUTR | Global Sustainable Equity Active ETF | |

| ASX | Loftus Peak | LOF01 | Loftus Peak Global Disruption Fund | |

| ASX | Loomis Sayles | LSGE | Loomis Sayles Global Equity Fund (Quoted) | |

| ASX | Magellan | MHHT | Magellan High Conviction Trust | |

| ASX | Monash Investors | MAAT | Monash Absolute Active Trust | |

| ASX | Montaka Global Investments | MOGL | Montaka Global Long Only Equities Fund | |

| ASX | Munro Partners | MAET | Munro Global Growth Fund | |

| ASX | Munro Partners | MCCL | Munro Climate Change Leaders Fund | |

| ASX | Munro Partners | MCGG | Munro Concentrated Global Growth Fund | |

| ASX | Perennial | IMPQ | Perennial Better Future Fund | |

| ASX | Perpetual | GIVE | Perpetual ESG Australian Share Fund | |

| ASX | Perpetual | IDEA | Perpetual Global Innovation Share Fund | |

| ASX | Russell Investments | Equity Income | RDV | Russell Investments High Dividend Australian Shares ETF |

| ASX | Russell Investments | Fixed Income | RCB | Russell Investments Australian Select Corporate Bond ETF |

| ASX | Russell Investments | Fixed Income | RGB | Russell Investments Australian Government Bond ETF |

| ASX | Russell Investments | Fixed Income | RSM | Russell Investments Australian Semi-Government Bond ETF |

| ASX | Russell Investments | Responsible Investing | RARI | Russell Investments Australian Responsible Investment ETF |

| ASX | Schroders | GROW | Schroder Real Return | |

| ASX | State Street Global Advisors SPDR® | BOND | SPDR® S&P®/ASX Australian Bond Fund | |

| ASX | State Street Global Advisors SPDR® | DJRE | SPDR® Dow Jones® Global Real Estate ESG Fund | |

| ASX | State Street Global Advisors SPDR® | E200 | SPDR® S&P®/ASX 200 ESG Fund | |

| ASX | State Street Global Advisors SPDR® | GOVT | SPDR® S&P®/ASX Australian Government Bond Fund | |

| ASX | State Street Global Advisors SPDR® | OZF | SPDR® S&P®/ASX 200 Financials EX A-REIT Fund | |

| ASX | State Street Global Advisors SPDR® | OZR | SPDR® S&P®/ASX 200 Resources Fund | |

| ASX | State Street Global Advisors SPDR® | QMIX | SPDR® MSCI World Quality Mix Fund | |

| ASX | State Street Global Advisors SPDR® | SFY | SPDR® S&P®/ASX 50 Fund | |

| ASX | State Street Global Advisors SPDR® | SLF | SPDR® S&P®/ASX 200 Listed Property Fund | |

| ASX | State Street Global Advisors SPDR® | SPY | SPDR® S&P 500® ETF Trust | |

| ASX | State Street Global Advisors SPDR® | SSO | SPDR® S&P®/ASX Small Ordinaries Fund | |

| ASX | State Street Global Advisors SPDR® | STW | SPDR® S&P®/ASX 200 Fund | |

| ASX | State Street Global Advisors SPDR® | SYI | SPDR® MSCI Australia Select High Dividend Yield Fund | |

| ASX | State Street Global Advisors SPDR® | WDIV | SPDR® S&P® Global Dividend Fund | |

| ASX | State Street Global Advisors SPDR® | WEMG | SPDR® S&P® Emerging Markets Carbon Control Fund | |

| ASX | State Street Global Advisors SPDR® | WXHG | SPDR® S&P® World ex Australia Carbon Control (Hedged) Fund | |

| ASX | State Street Global Advisors SPDR® | WXOZ | SPDR® S&P® World ex Australia Carbon Control Fund | |

| ASX | The Perth Mint | Commodities | PMGOLD | Perth Mint Gold |

| ASX | VanEck | Alternative Assets - Carbon Credits | XCO2 | Global Carbon Credits ETF (Synthetic) |

| ASX | VanEck | Alternative Assets - Gold | NUGG | Gold Bullion ETF |

| ASX | VanEck | Alternative Assets - Private Equity | GPEQ | Global Listed Private Equity ETF |

| ASX | VanEck | Equity - Australian Broad Based | MVW | Australian Equal Weight ETF |

| ASX | VanEck | Equity - Australian Equity Income | DVDY | Morningstar Australian Moat Income ETF |

| ASX | VanEck | Equity - Australian Sector | MVA | Australian Property ETF |

| ASX | VanEck | Equity - Australian Sector | MVB | Australian Banks ETF |

| ASX | VanEck | Equity - Australian Sector | MVR | Australian Resources ETF |

| ASX | VanEck | Equity - Australian Small & Mid Companies | MVE | S&P/ASX MidCap ETF |

| ASX | VanEck | Equity - Australian Small & Mid Companies | MVS | Small Companies Masters ETF |

| ASX | VanEck | Equity - Global Sector | GDX | Gold Miners ETF |

| ASX | VanEck | Equity - Global Sector | HLTH | Global Healthcare Leaders ETF |

| ASX | VanEck | Equity - Global Sector | IFRA | FTSE Global Infrastructure (Hedged) ETF |

| ASX | VanEck | Equity - Global Sector | REIT | FTSE International Property (Hedged) ETF |

| ASX | VanEck | Equity - International | CETF | FTSE China A50 ETF |

| ASX | VanEck | Equity - International | CNEW | China New Economy ETF |

| ASX | VanEck | Equity - International | EMKT | MSCI Multifactor Emerging Markets Equity ETF |

| ASX | VanEck | Equity - International | GOAT | Morningstar International Wide Moat ETF |

| ASX | VanEck | Equity - International | HVLU | MSCI International Value (AUD Hedged) ETF |

| ASX | VanEck | Equity - International | MHOT | Morningstar Wide Moat (AUD Hedged) ETF |

| ASX | VanEck | Equity - International | MOAT | Morningstar Wide Moat ETF |

| ASX | VanEck | Equity - International | QHAL | MSCI International Quality (Hedged) ETF |

| ASX | VanEck | Equity - International | QUAL | MSCI International Quality ETF |

| ASX | VanEck | Equity - International | VLUE | MSCI International Value ETF |

| ASX | VanEck | Equity - International Small Companies | QHSM | MSCI International Small Companies Quality (AUD Hedged) ETF |

| ASX | VanEck | Equity - International Small Companies | QSML | MSCI International Small Companies Quality ETF |

| ASX | VanEck | Equity - Sustainable Investing | ESGI | MSCI International Sustainable Equity ETF |

| ASX | VanEck | Equity - Sustainable Investing | GRNV | MSCI Australian Sustainable Equity ETF |

| ASX | VanEck | Equity - Thematic | CLNE | Global Clean Energy ETF |

| ASX | VanEck | Equity - Thematic | ESPO | Video Gaming and eSports ETF |

| ASX | VanEck | Fixed Income - Australian | 1GOV | 1-5 Year Australian Government Bond ETF |

| ASX | VanEck | Fixed Income - Australian | 5GOV | 5-10 Year Australian Government Bond ETF |

| ASX | VanEck | Fixed Income - Australian | FLOT | Australian Floating Rate ETF |

| ASX | VanEck | Fixed Income - Australian | PLUS | Australian Corporate Bond Plus ETF |

| ASX | VanEck | Fixed Income - Australian | XGOV | 10+ Year Australian Government Bond ETF |

| ASX | VanEck | Fixed Income - Capital Securities | GCAP | Global Capital Securities Active ETF (Managed Fund) |

| ASX | VanEck | Fixed Income - Capital Securities | SUBD | Australian Subordinated Debt ETF |

| ASX | VanEck | Fixed Income - Global | EBND | Emerging Income Opportunities Active ETF (Managed Fund) |

| ASX | VanEck | Fixed Income - Global | TBIL | 1-3 Month US Treasury Bond ETF |

| ASX | Vanguard | Diversified | VDBA | Diversified Balanced Index ETF |

| ASX | Vanguard | Diversified | VDCO | Diversified Conservative Index ETF |

| ASX | Vanguard | Diversified | VDGR | Diversified Growth Index ETF |

| ASX | Vanguard | Diversified | VDHG | Diversified High Growth Index ETF |

| ASX | Vanguard | Equities - Australian | VAS | Australian Shares Index ETF |

| ASX | Vanguard | Equities - Australian | VETH | Ethically Conscious Australian Shares ETF |

| ASX | Vanguard | Equities - Australian | VHY | Australian Shares High Yield ETF |

| ASX | Vanguard | Equities - Australian | VLC | MSCI Australian Large Companies Index ETF |

| ASX | Vanguard | Equities - Australian | VSO | MSCI Australian Small Companies Index ETF |

| ASX | Vanguard | Equities - International | VAE | FTSE Asia ex Japan Shares Index ETF |

| ASX | Vanguard | Equities - International | VEQ | FTSE Europe Shares ETF |

| ASX | Vanguard | Equities - International | VESG | Ethically Conscious International Shares Index ETF |

| ASX | Vanguard | Equities - International | VEU | All-World ex-U.S. Shares Index ETF (Unavailable on Vanguard Personal Investor) |

| ASX | Vanguard | Equities - International | VGAD | MSCI Index International Shares (Hedged) ETF |

| ASX | Vanguard | Equities - International | VGE | FTSE Emerging Markets Shares ETF |

| ASX | Vanguard | Equities - International | VGS | MSCI Index International Shares ETF |

| ASX | Vanguard | Equities - International | VISM | MSCI International Small Companies Index ETF |

| ASX | Vanguard | Equities - International | VMIN | Vanguard Global Minimum Volatility Active ETF (Managed Fund) |

| ASX | Vanguard | Equities - International | VTS | U.S. Total Market Shares Index ETF (Unavailable on Vanguard Personal Investor) |

| ASX | Vanguard | Equities - International | VVLU | Vanguard Global Value Equity Active ETF (Managed Fund) |

| ASX | Vanguard | Fixed Interest | VACF | Australian Corporate Fixed Interest Index ETF |

| ASX | Vanguard | Fixed Interest | VAF | Australian Fixed Interest Index ETF |

| ASX | Vanguard | Fixed Interest | VBND | Global Aggregate Bond Index (Hedged) ETF |

| ASX | Vanguard | Fixed Interest | VCF | International Credit Securities Index (Hedged) ETF |

| ASX | Vanguard | Fixed Interest | VEFI | Ethically Conscious Global Aggregate Bond Index (Hedged) ETF |

| ASX | Vanguard | Fixed Interest | VGB | Australian Government Bond Index ETF |

| ASX | Vanguard | Fixed Interest | VIF | International Fixed Interest Index (Hedged) ETF |

| ASX | Vanguard | Infrastructure | VBLD | Global Infrastructure Index ETF |

| ASX | Vanguard | Property | VAP | Australian Property Securities Index ETF |

| Commodity | Category | Sub-Category |

|---|---|---|

| Adzuki Bean | Agricultural | Grains, Food and Fiber |

| Aluminium | Metals | Industrial |

| Aluminium Alloy | Metals | Industrial |

| Amber | Other | - |

| Brent Crude Oil | Energy | - |

| Cobalt | Metals | Industrial |

| Cocoa | Agricultural | Grains, Food and Fiber |

| Cocoa C | Agricultural | Grains, Food and Fiber |

| Corn | Agricultural | Grains, Food and Fiber |

| Cotton No.2 | Agricultural | Grains, Food and Fiber |

| Ethanol | Energy | - |

| Feeder Cattle | Agricultural | Livestock and Meat |

| Frozen Concentrated Orange Juice | Agricultural | Grains, Food and Fiber |

| Gold | Metals | Precious |

| Gulf Coast Gasoline | Energy | - |

| Hardwood Pulp | Forest Products | - |

| Heating Oil | Energy | - |

| Lead | Metals | Industrial |

| Lean Hogs | Agricultural | Livestock and Meat |

| Live Cattle | Agricultural | Livestock and Meat |

| LME Copper | Metals | Industrial |

| LME Nickel | Metals | Industrial |

| Milk | Agricultural | Grains, Food and Fiber |

| Molybdenum | Metals | Industrial |

| Natural Gas | Energy | - |

| No 2. Soybean | Agricultural | Grains, Food and Fiber |

| Oats | Agricultural | Grains, Food and Fiber |

| Palladium | Metals | Precious |

| Palm Oil | Other | - |

| Platinum | Metals | Precious |

| Propane | Energy | - |

| Purified Terephthalic Acid (PTA) | Energy | - |

| Random Length Lumber | Forest Products | - |

| Rapeseed | Agricultural | Grains, Food and Fiber |

| RBOB Gasoline (Reformulated gasoline Blendstock for Oxygen Blending) | Energy | - |

| Recycled Steel | Metals | Industrial |

| Robusta Coffee | Agricultural | Grains, Food and Fiber |

| Rough Rice | Agricultural | Grains, Food and Fiber |

| Rubber | Other | - |

| Silver | Metals | Precious |

| Softwood Pulp | Forest Products | - |

| Soy Meal | Agricultural | Grains, Food and Fiber |

| Soybean Meal | Agricultural | Grains, Food and Fiber |

| Soybean Oil | Agricultural | Grains, Food and Fiber |

| Soybeans | Agricultural | Grains, Food and Fiber |

| Sugar No.11 | Agricultural | Grains, Food and Fiber |

| Sugar No.14 | Agricultural | Grains, Food and Fiber |

| Tin | Metals | Industrial |

| Wheat | Agricultural | Grains, Food and Fiber |

| Wool | Other | - |

| WTI Crude Oil | Energy | - |

| Zinc | Metals | Industrial |

Derivatives are financial instruments whose value is derived from the price of an underlying asset or index.

They are used for hedging, speculation, and arbitrage.

Below are some common derivatives, along with their definitions and uses:

Definition: A futures contract is a standardized agreement to buy or sell an asset at a specific price at a future date. The contract is traded on an exchange.

Uses:

Example: A farmer may sell wheat futures to guarantee a price for their crop, while a speculator might buy wheat futures, betting that the price will rise.

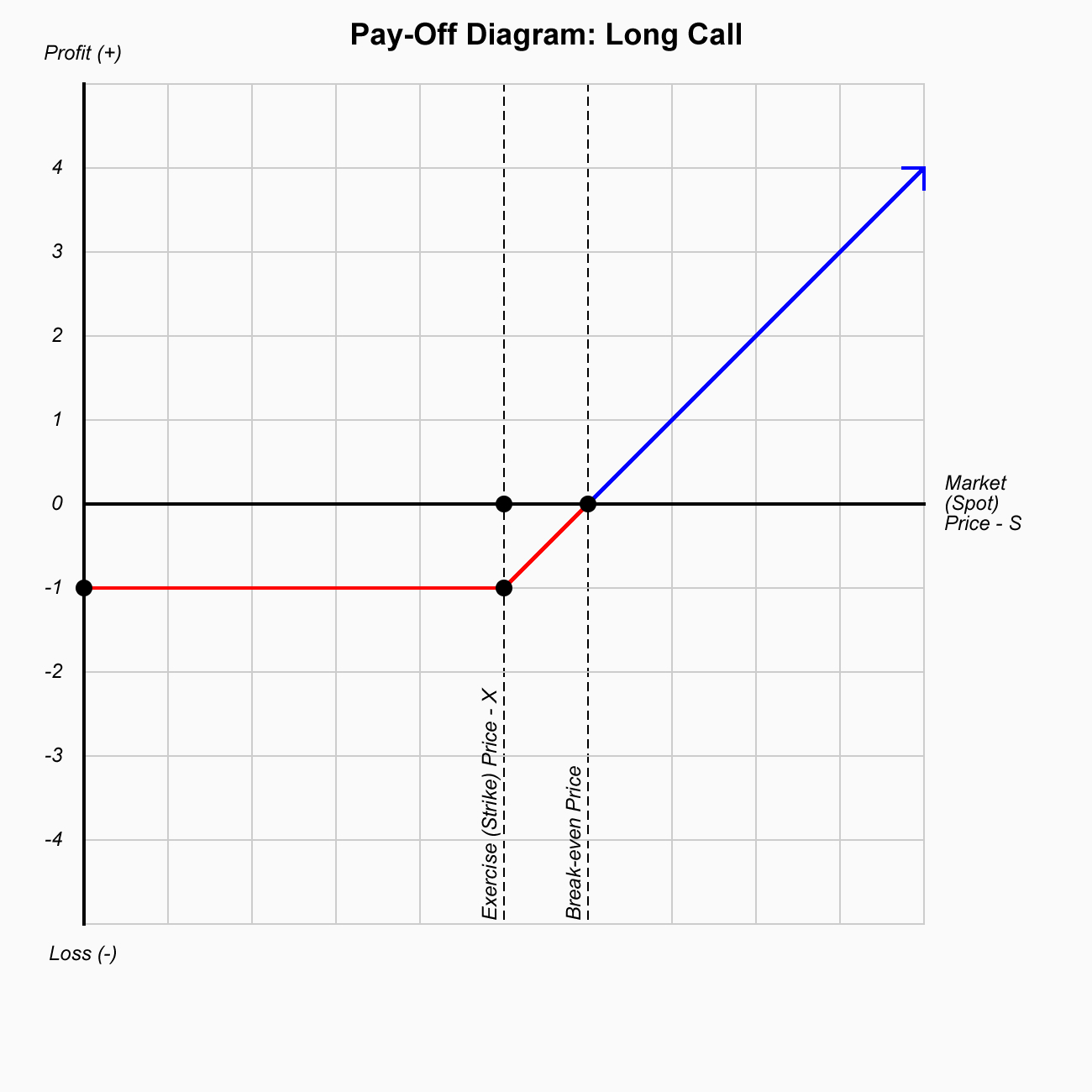

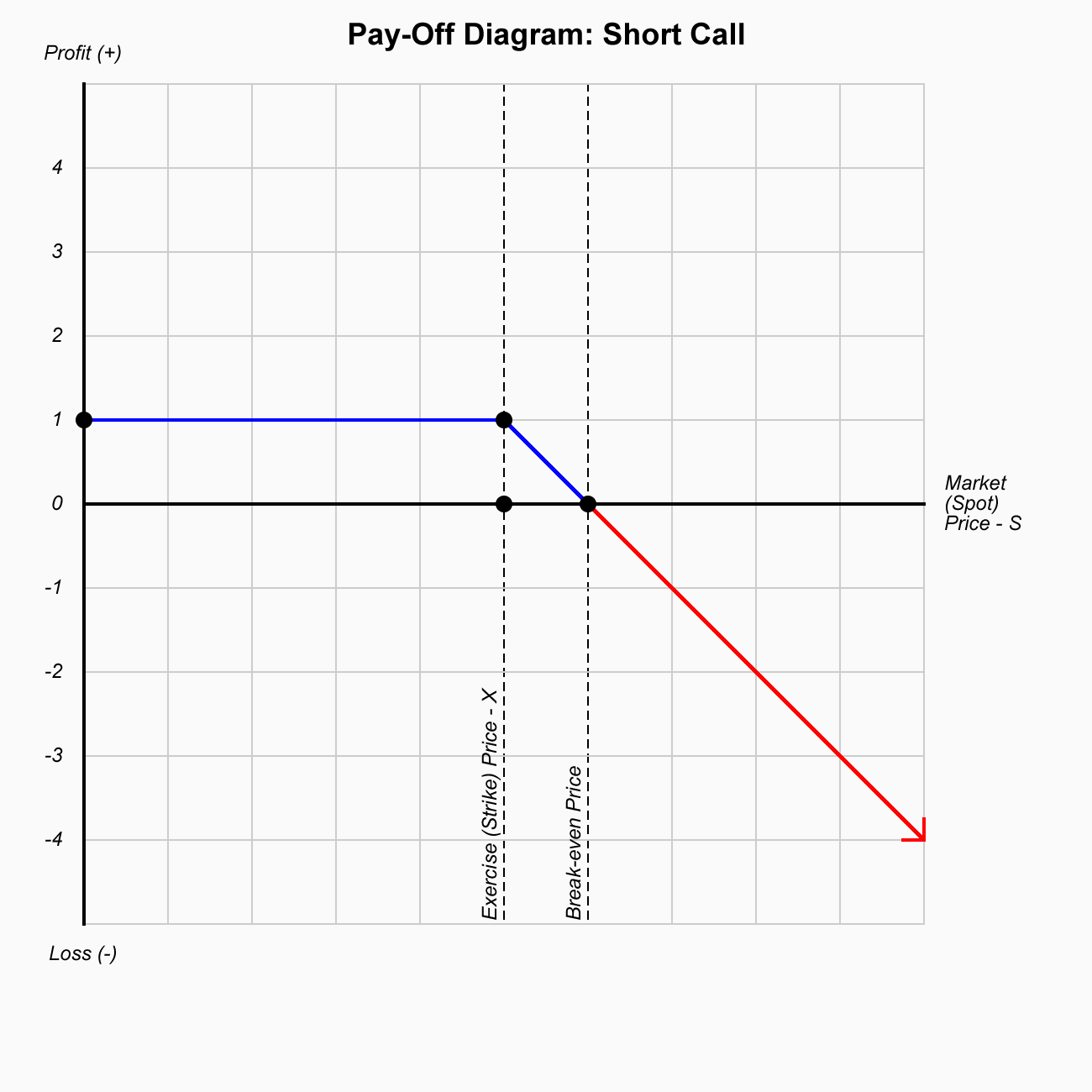

Definition: An option is a contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before or on a specified expiration date.

Uses:

Example: A call option on a stock gives the buyer the right to buy the stock at the strike price (e.g., $100) before the expiration date. If the stock price rises above $100, the buyer can profit by exercising the option or selling it at a higher premium.

Definition: A swap is a derivative contract in which two parties exchange cash flows or financial instruments over a specified period. Common types of swaps include:

Uses:

Example: A company with a variable-rate loan may enter into an interest rate swap to exchange its variable payments for fixed-rate payments, thereby reducing the uncertainty of its future interest costs.

Definition: Exotic options are more complex than standard options (calls and puts). They may have unique features, such as different payoff structures, underlying assets, or conditions for exercising the option. Some common types include:

Uses:

Example: A barrier option may be a “knock-in” call option, which becomes activated only if the underlying stock price rises above a certain level, providing a more cost-effective way to speculate on price movements than traditional options.

Definition: A warrant is a type of option issued by a company that gives the holder the right to buy shares of the company at a specific price (strike price) before a set expiration date. Warrants are typically issued in conjunction with bond or preferred stock offerings as an added incentive for investors.

Uses:

Example: A company may issue a warrant that allows investors to buy shares at $50 each for the next five years. If the stock price rises above $50, the investor can exercise the warrant and buy shares at a discount.

Definition: A forward contract is a private, non-standardized agreement between two parties to buy or sell an asset at a future date for a price agreed upon today. Unlike futures contracts, forwards are not traded on exchanges.

Uses:

Example: A company that imports goods from another country may enter into a forward contract to lock in the exchange rate for the foreign currency it will need to pay in the future.

Definition: A credit default swap is a financial derivative that allows an investor to “swap” or transfer the credit risk of a reference entity (such as a corporation or government) to another party.

Uses:

Example: An investor holding corporate bonds may buy a CDS as protection against the risk of the company defaulting on its debt.

Derivatives are powerful financial tools that serve various purposes, from managing risk and hedging to enabling speculation and arbitrage. The choice of derivative depends on the specific needs of the market participants, whether it’s to manage the risk of price movements, take advantage of market inefficiencies, or enhance returns with leverage. While futures, options, swaps, and exotic options are some of the most commonly used derivatives, each type has unique features that make it more suitable for certain market conditions or objectives.

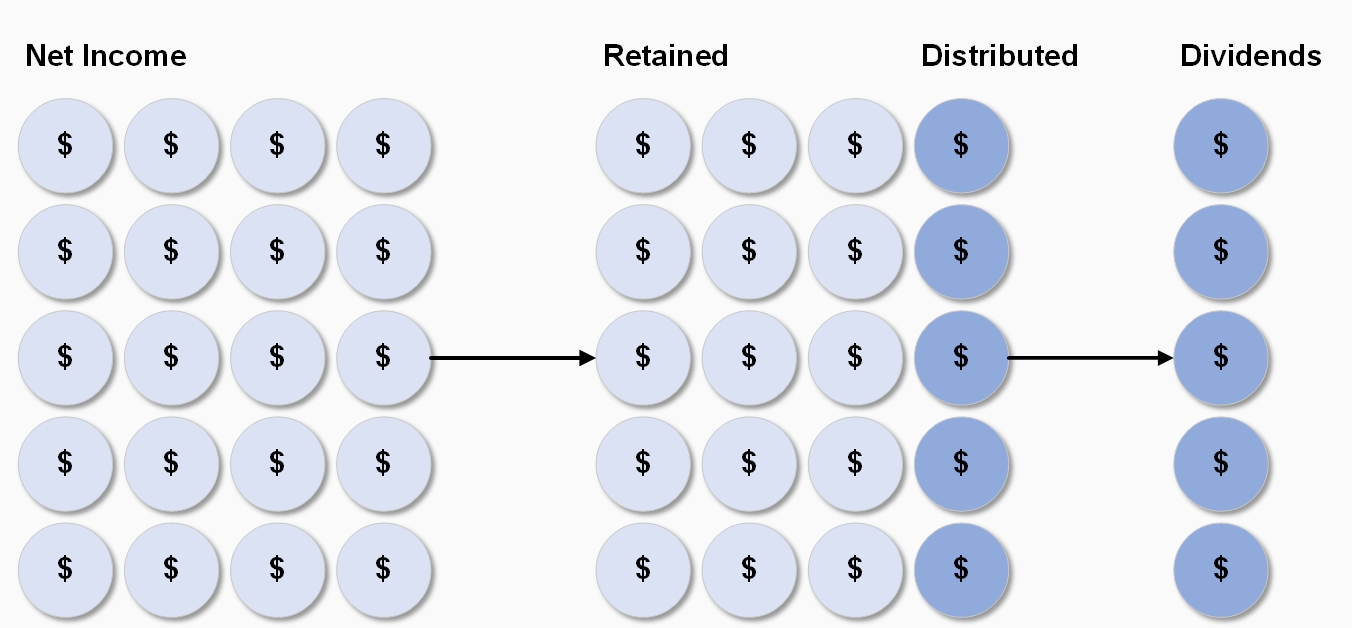

A payment paid regularly by a company to its shareholders out of its profits (or reserves). Interim dividends are generally paid out of surplus profits (reserved) of the previous years, whereas final dividends are declared and paid out on an annual basis after the earnings are known for that financial year. Additionally, companies may pay a bonus dividend.

A company typically divides its profits between itself and its shareholders. Distributions represent a portion of the profits a company decides to give to its shareholders, while retained earnings represent the portion of profits that a company chooses to keep. Companies choose to share profits in the form of dividends because it encourages shareholders to continue investing in the company. Understanding the transactions pertaining to dividends and retained earnings helps you know the effects of the transactions on a company’s financial statements.

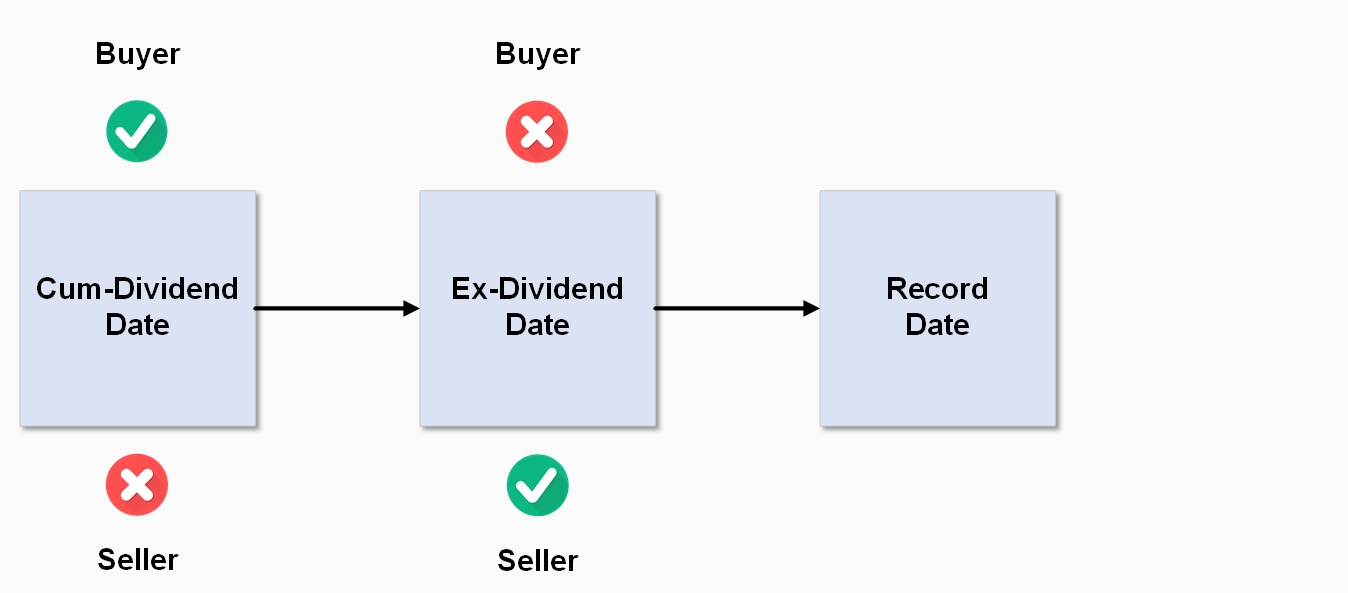

The ex-dividend date occurs one business day before the company’s Record Date.

Important: To be entitled to the dividend, the buyer needs to purchase the shares prior to the ex-dividend date! If you purchase shares on the ex-dividend date, the seller will be entitled to the dividend payment.

The record date is 5.00pm on the date a company closes its share register to determine which shareholders are entitled to receive the current dividend. It is the date where all changes to registration details must be finalised.

$$\begin{aligned} Dividend\;Yield\; &=\;\left [ (Interim\;Dividend + Final\;Dividend) \over Current\;Share\;Price\right ] \;*\;100\;\\\\\ &= \;\left [ Dividends \over Current\;Share\;Price \right ] \;*\;100\;\end{aligned}$$

See also: Franking (Imputation) Credits

| Rank | Symbol | Name | Market Capitalisation (USD$ Billions) |

|---|---|---|---|

| 1 | NVDA | NVIDIA Corporation | 3,563.23 |

| 2 | AAPL | Apple Inc. | 3,389.42 |

| 3 | MSFT | Microsoft Corporation | 3,107.85 |

| 4 | AMZN | Amazon.com, Inc. | 2,174.92 |

| 5 | WMT | Walmart Inc. | 676.90 |

| 6 | JPM | JPMorgan Chase & Co. | 673.68 |

| 7 | V | Visa Inc. | 590.13 |

| 8 | UNH | UnitedHealth Group Incorporated | 575.41 |

| 9 | HD | The Home Depot, Inc. | 405.55 |

| 10 | PG | The Procter & Gamble Company | 391.01 |

| 11 | JNJ | Johnson & Johnson | 373.28 |

| 12 | CRM | Salesforce, Inc. | 326.69 |

| 13 | CVX | Chevron Corporation | 281.24 |

| 14 | KO | The Coca-Cola Company | 272.94 |

| 15 | MRK | Merck & Co., Inc. | 254.81 |

| 16 | CSCO | Cisco Systems, Inc. | 233.98 |

| 17 | MCD | McDonald's Corporation | 216.08 |

| 18 | AXP | American Express Company | 206.38 |

| 19 | GS | The Goldman Sachs Group, Inc. | 198.30 |

| 20 | IBM | International Business Machines Corporation | 197.48 |

| 21 | CAT | Caterpillar Inc. | 191.45 |

| 22 | DIS | The Walt Disney Company | 183.16 |

| 23 | AMGN | Amgen Inc. | 172.98 |

| 24 | VZ | Verizon Communications Inc. | 170.24 |

| 25 | HON | Honeywell International Inc. | 146.46 |

| 26 | NKE | NIKE, Inc. | 114.02 |

| 27 | BA | The Boeing Company | 111.36 |

| 28 | SHW | The Sherwin-Williams Company | 97.70 |

| 29 | MMM | 3M Company | 72.43 |

| 30 | TRV | The Travelers Companies, Inc. | 58.65 |

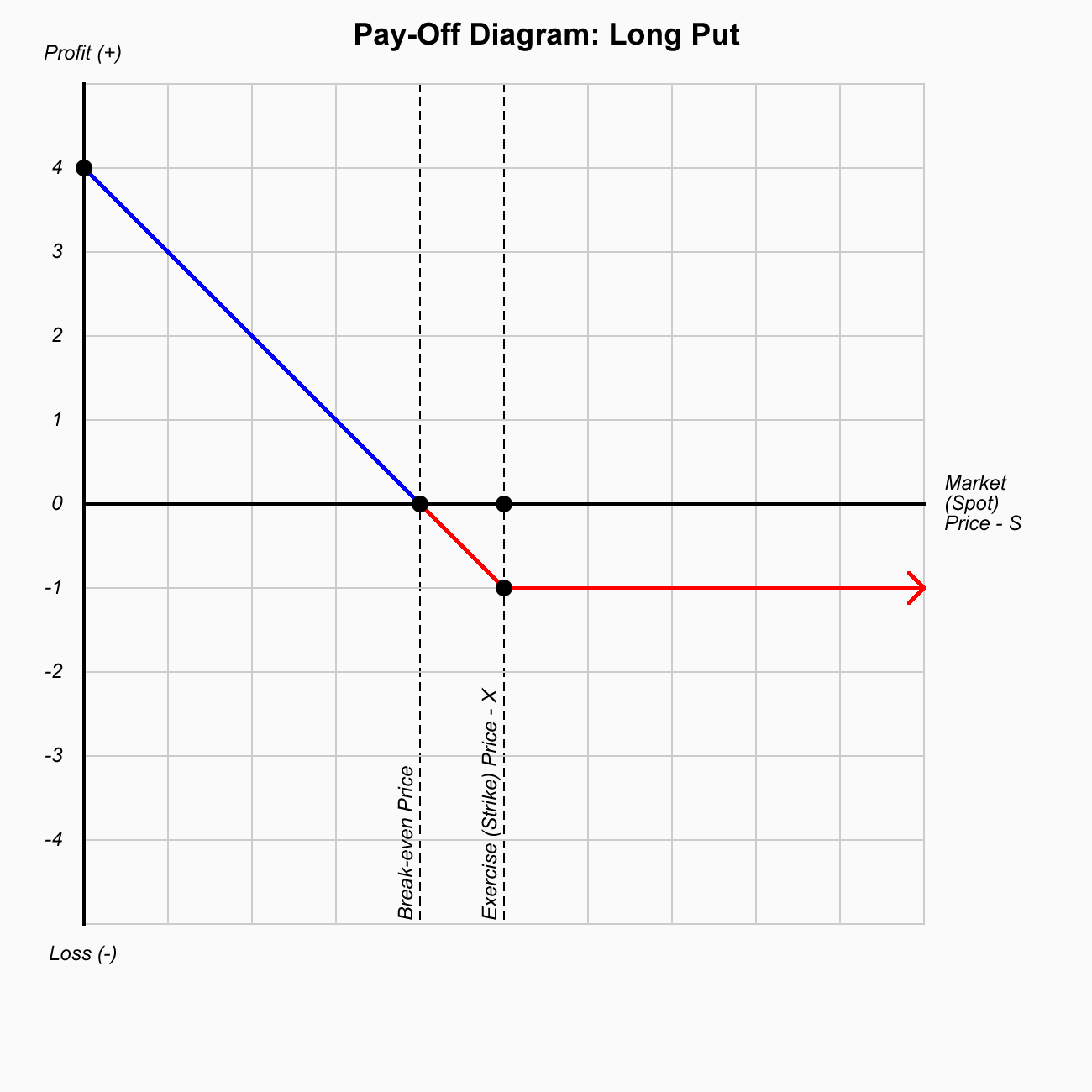

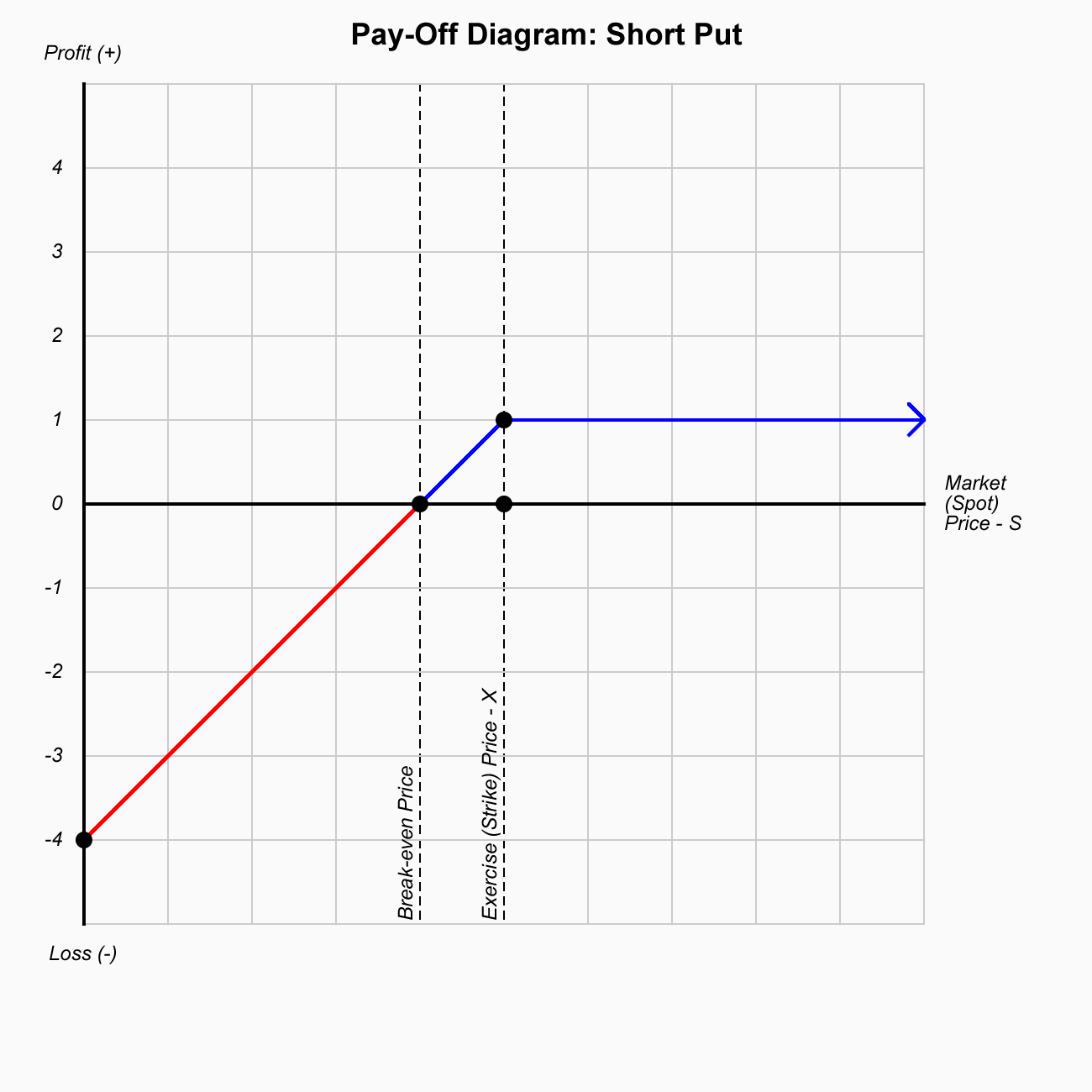

Options are contracts where you have the right but not the obligation to either buy (call ) or sell (put) financial instruments at the exercise (strike) price on or before a predetermined date.

$$V = max(S-X, 0)-P $$

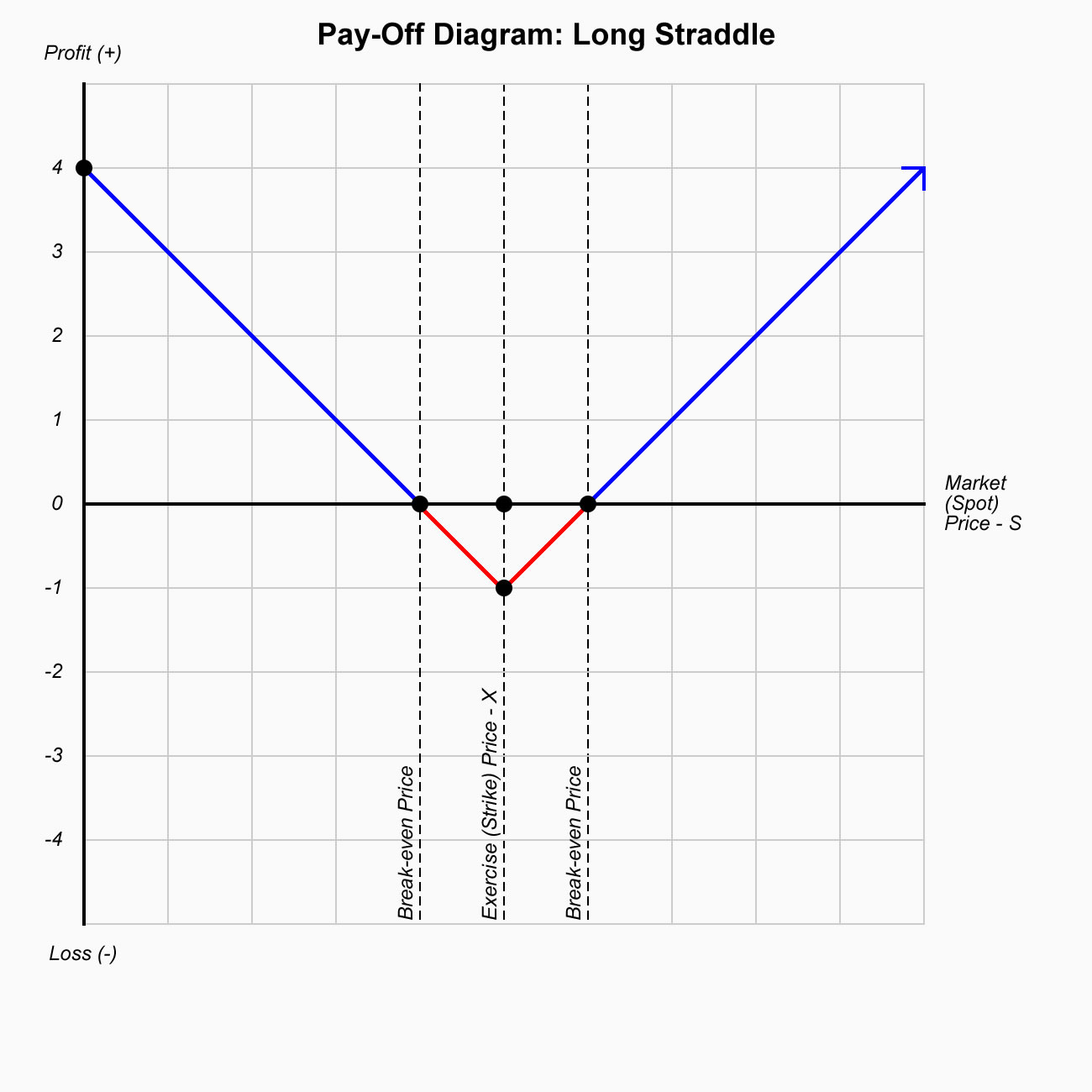

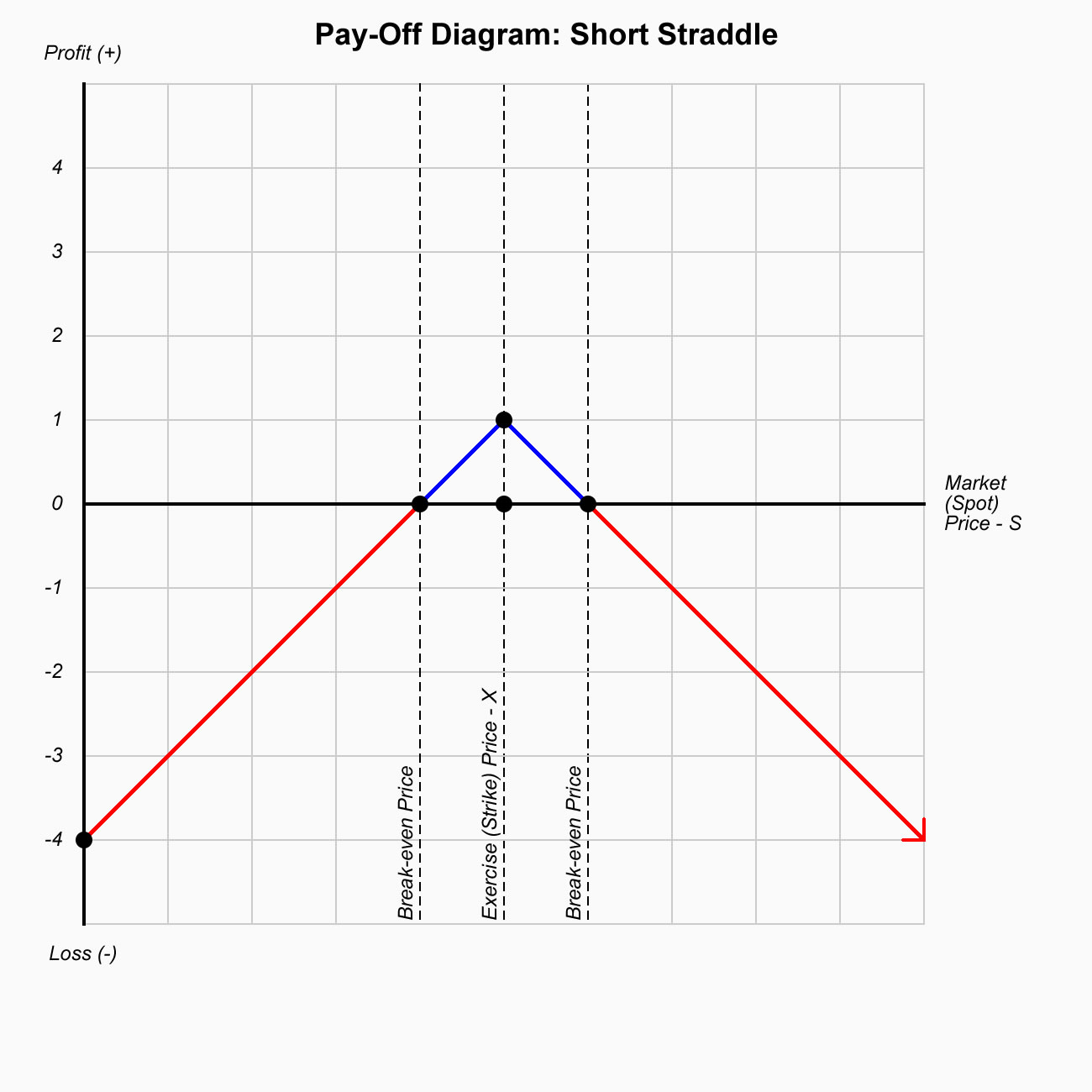

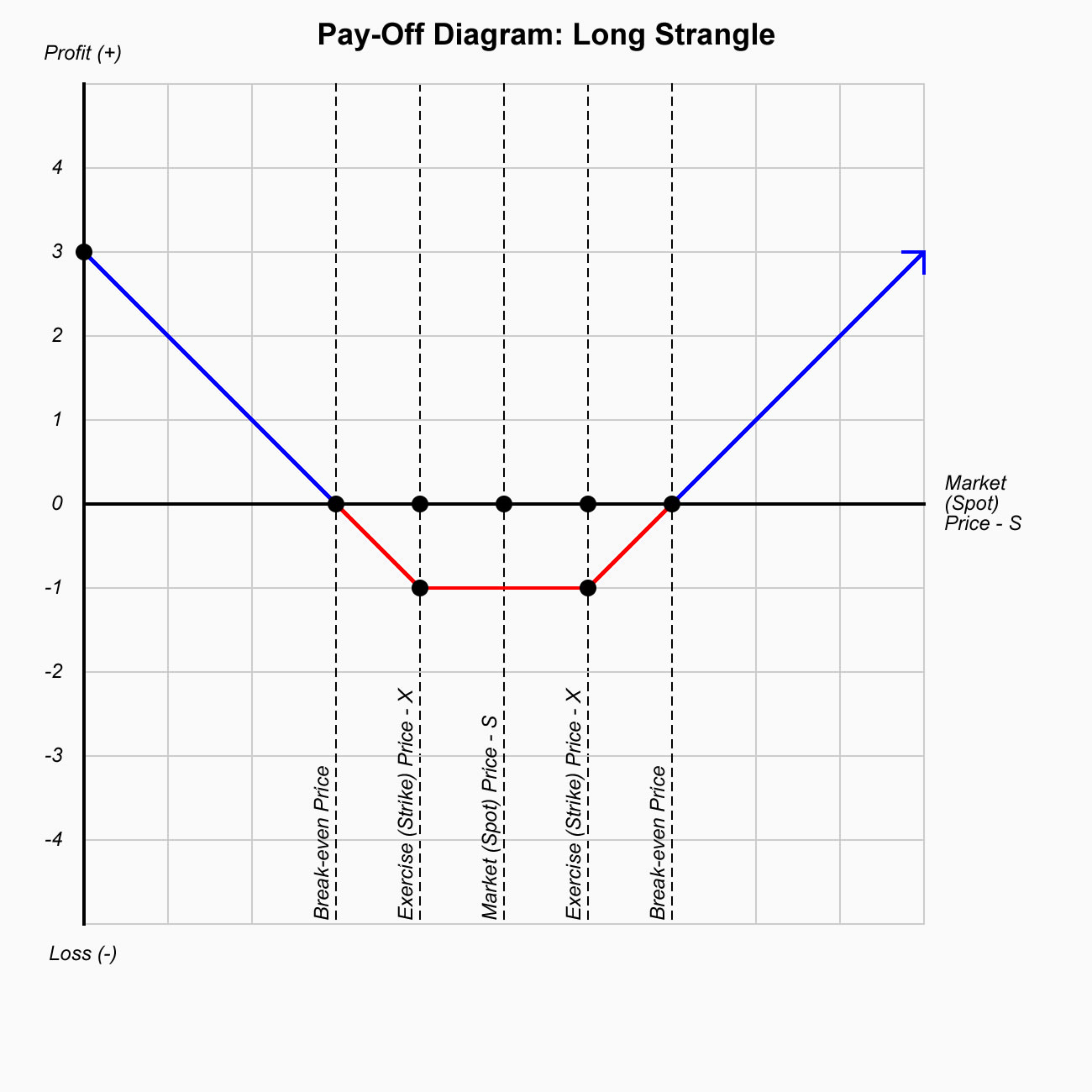

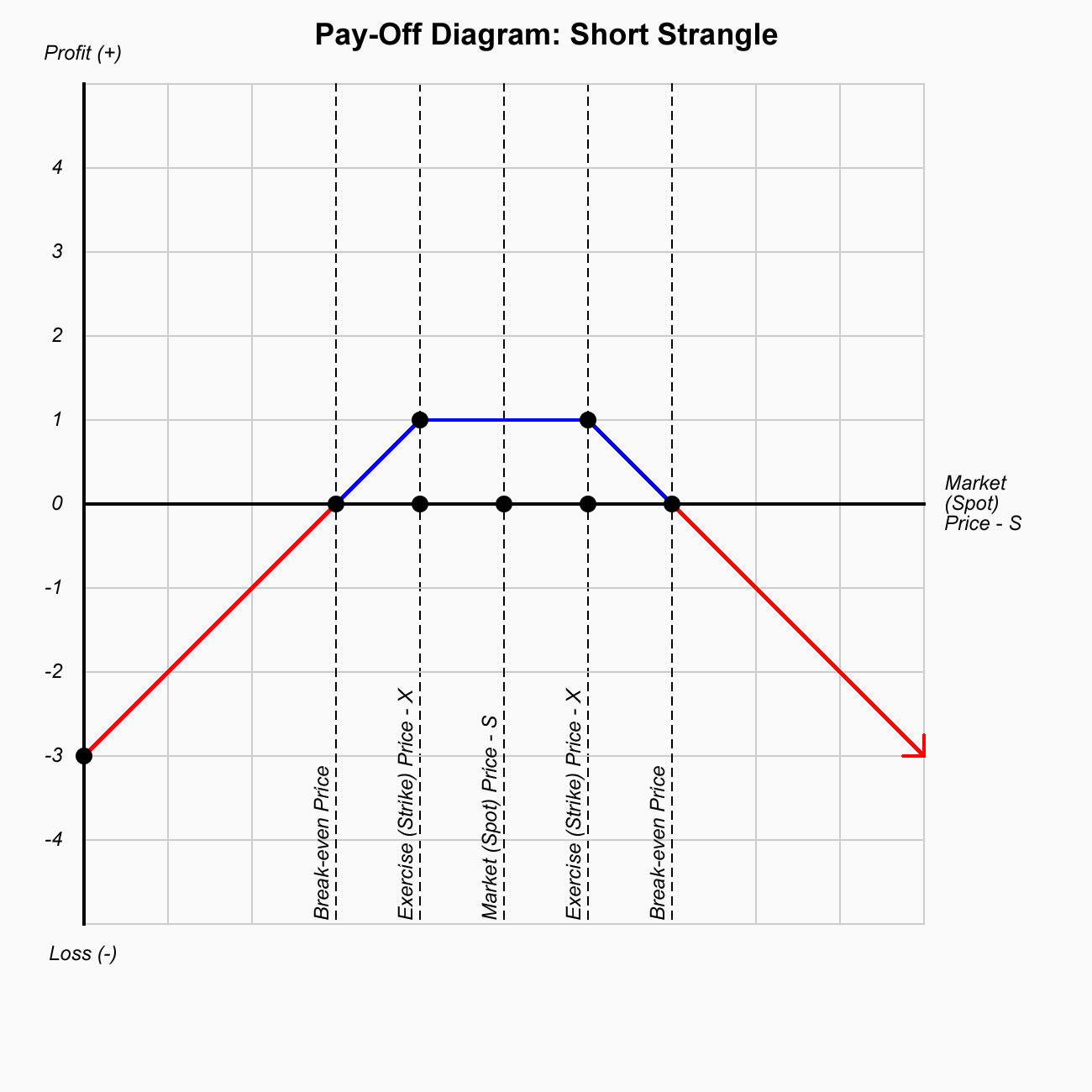

With this strategy, a trader is looking for a major move; either up or down in the underlying stock before expiration. This market neutral strategy is specifically designed for high volatility conditions where stocks are swinging wildly back and forth.

aaa