Last Updated on 2021-12-28 by Admin

A payment paid regularly by a company to its shareholders out of its profits (or reserves). Interim dividends are generally paid out of surplus profits (reserved) of the previous years, whereas final dividends are declared and paid out on an annual basis after the earnings are known for that financial year. Additionally, companies may pay a bonus dividend.

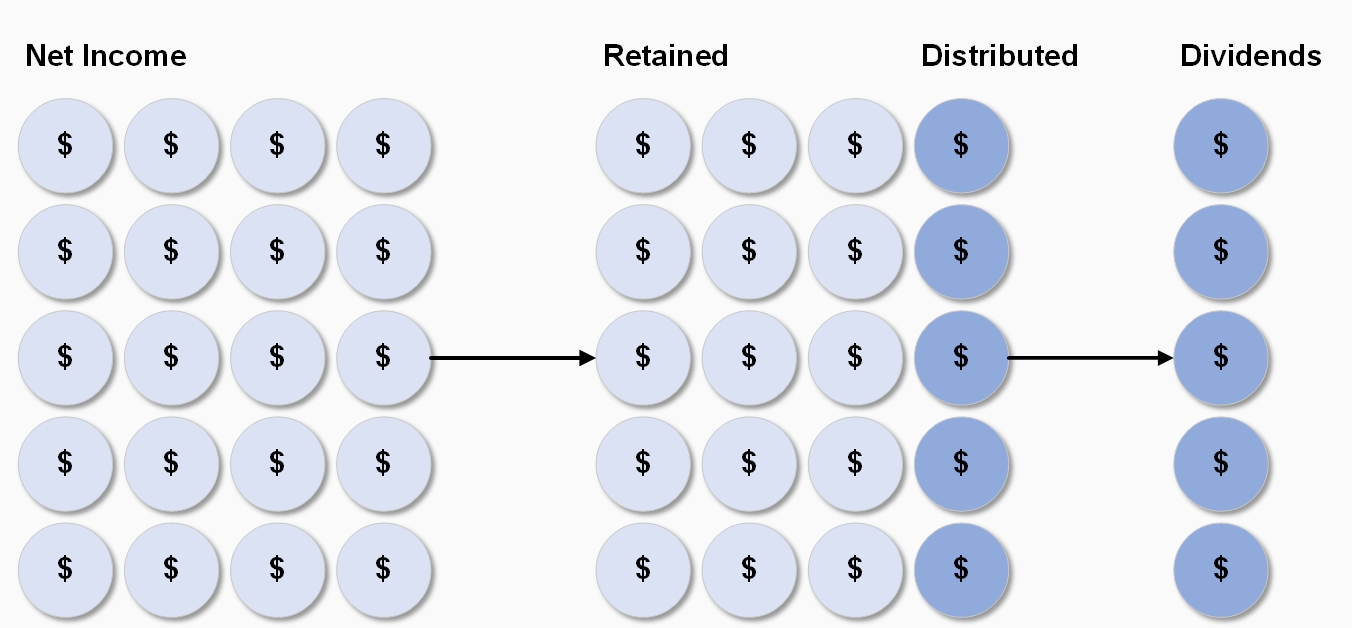

A company typically divides its profits between itself and its shareholders. Distributions represent a portion of the profits a company decides to give to its shareholders, while retained earnings represent the portion of profits that a company chooses to keep. Companies choose to share profits in the form of dividends because it encourages shareholders to continue investing in the company. Understanding the transactions pertaining to dividends and retained earnings helps you know the effects of the transactions on a company’s financial statements.

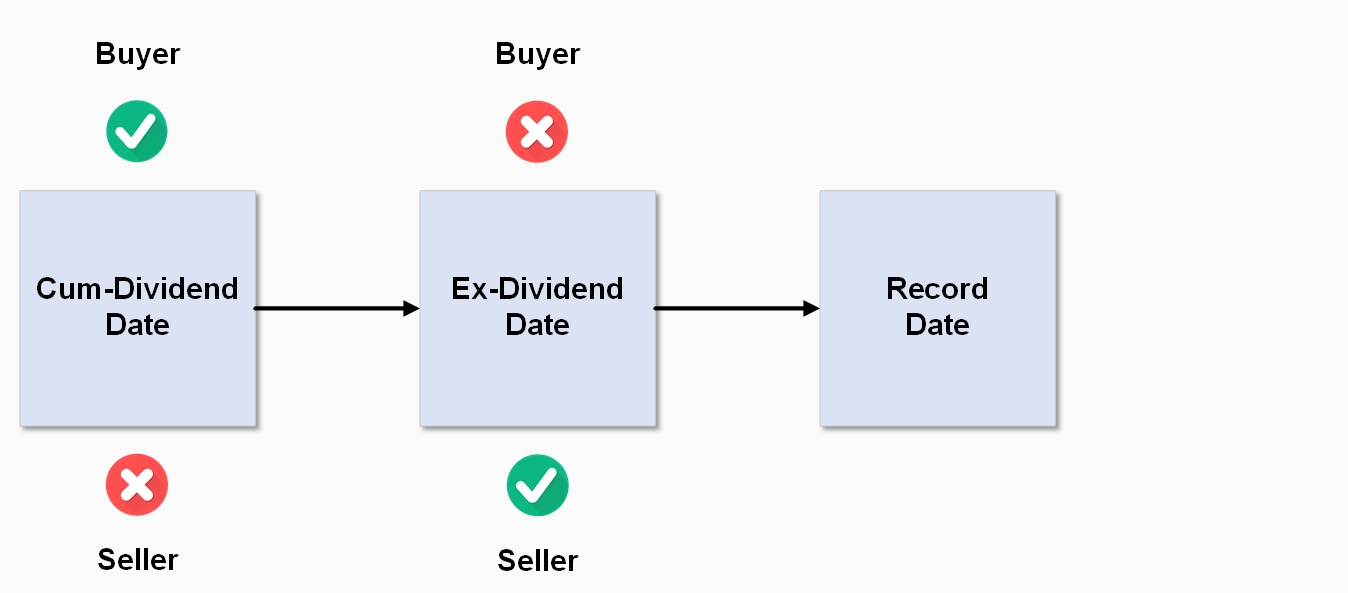

The ex-dividend date occurs one business day before the company’s Record Date.

Important: To be entitled to the dividend the shareholder must have purchased the shares prior to the ex-dividend date!

If you purchase shares on the ex-dividend date, the previous owner (seller) of the shares (and not you) will be entitled to the dividend payment.

The record date is 5.00pm on the date a company closes its share register to determine which shareholders are entitled to receive the current dividend. It is the date where all changes to registration details must be finalised.

$$\begin{aligned} Dividend\;Yield\; &=\;\left [ (Interim\;Dividend + Final\;Dividend) \over Current\;Share\;Price\right ] \;*\;100\;\\\\\ &= \;\left [ Dividends \over Current\;Share\;Price \right ] \;*\;100\;\end{aligned}$$

See also: Franking (Imputation) Credits