A Cash-Secured Put is an options trading strategy that involves selling a put option while setting aside sufficient cash to purchase the underlying asset (if the put option is exercised). This strategy is commonly used by investors who are willing to buy the underlying asset at a certain price (the strike price of the put) in exchange for receiving an upfront premium from selling the put option.

This strategy is considered conservative and is typically employed when an investor has a neutral to slightly bullish outlook on the underlying asset and is looking to generate income through premiums while potentially acquiring the asset at a price lower than its current market value.

The main goal of a cash-secured put is to generate income from the premium received from selling the put option while keeping the possibility of acquiring the underlying asset at a discount (the strike price) if the option is exercised. It is used in scenarios where the investor is willing to buy the asset at the strike price but is also content with keeping the premium if the option expires worthless.

The maximum profit occurs when the put option expires worthless (i.e., the price of the underlying asset remains above the strike price). In this case, the investor keeps the full premium received for selling the put option as profit.

Mathematically:

Maximum Loss

The maximum loss occurs if the price of the underlying asset falls to zero. In this case, the investor would have to buy the asset at the strike price, which would result in a significant loss. However, this loss is partially offset by the premium received from selling the put option.

Mathematically:

Breakeven Point

The breakeven point is the price at which the investor will neither make a profit nor a loss. It occurs when the price of the underlying asset is equal to the strike price minus the premium received.

Mathematically:

Example

Let’s say an investor is interested in selling a cash-secured put on a stock currently trading at $50. The investor decides to sell a put option with a strike price of $45, expiring in one month, and receives a premium of $2 per share.

Outcomes

Pros

Cons

Example Summary

A cash-secured put is a relatively conservative strategy used to generate income through the premium received from selling put options, while also providing the opportunity to acquire the underlying asset at a discount if the option is exercised. The strategy is best suited for investors with a neutral to bullish outlook who are willing to own the asset at the strike price and are looking to generate income in a stable or slightly bullish market. The maximum risk is limited to the strike price of the put minus the premium received, and the maximum profit is limited to the premium received.

A Cash-Secured Call (also known as a Cash-Backed Call) is a conservative options trading strategy that involves selling a covered call while having sufficient cash or liquid assets set aside to buy the underlying asset if the call is exercised. It’s similar to a covered call but instead of owning the underlying asset, the trader sets aside cash as collateral in case they need to buy the asset.

This strategy is typically used when the investor has a neutral to slightly bullish outlook on the underlying asset and aims to generate income from the premium received by selling the call option. The main difference between a cash-secured call and a standard covered call is that the cash-secured call does not require the investor to already own the underlying asset but instead uses cash to guarantee the potential purchase of the asset.

The objective of a cash-secured call is to generate income through the premiums received from selling the call option while maintaining the ability to purchase the underlying asset if the call is exercised. It’s a neutral to slightly bullish strategy that allows an investor to earn money in a relatively flat or mildly rising market, without having to own the underlying asset in advance.

Maximum Profit

The maximum profit in a cash-secured call strategy is limited to the premium received from selling the call option. Even if the price of the underlying asset rises significantly, the maximum profit is capped at the strike price plus the premium received.

Mathematically:

Maximum Loss

The maximum loss occurs if the price of the underlying asset falls to zero. This is because the trader still holds the cash-secured position but has no offsetting premium income (if the option expires worthless and the asset becomes worthless).

However, because the trader has set aside the cash to buy the asset, the maximum loss is limited to the full price of purchasing the underlying asset at the strike price (which would occur if the call is exercised).

Mathematically:

Breakeven Point

The breakeven point is the price at which the investor will not make a profit or loss from the strategy. It is calculated by taking the strike price of the call and subtracting the premium received from selling the call option.

Mathematically:

Example

Let’s assume a stock is currently trading at $50, and you want to sell a cash-secured call on this stock:

Outcomes

Risk/Reward Profile

Pros

Cons

Example Summary

Aside Cash: $5,500 to buy the stock if exercised

A cash-secured call is a conservative options strategy that generates income through the premiums received from selling call options while setting aside cash to cover the potential purchase of the underlying asset if the option is exercised. It is best used in a neutral to slightly bullish market, where the investor expects little movement or slight appreciation in the asset’s price. The strategy offers limited risk, as the cash set aside can be used to purchase the asset if necessary, but the profit potential is capped at the premium received.

Buying Index Puts is a straightforward and popular options trading strategy used by investors who have a bearish outlook on an underlying stock index. In this strategy, the investor buys a put option on an index (such as the S&P 500, Nasdaq-100, or other indices), which gives the buyer the right, but not the obligation, to sell the underlying index at a specific strike price before or on the expiration date of the option.

The primary goal of buying index puts is to profit from a decline in the value of the underlying index, with the benefit of limited risk. If the index falls significantly below the strike price, the investor can either exercise the put (if the option is in the money) or sell the option to lock in profits.

The objective of buying an index put is to profit from a decline in the value of the underlying index. If the index falls below the strike price of the put option, the option becomes in the money, and the investor can sell the option at a profit or exercise the option to sell the index at a higher price than its current market value.

In simpler terms, buying an index put allows an investor to bet on a decrease in the market or a specific sector represented by the index. If the market falls, the value of the put option increases, potentially resulting in profits.

Maximum Profit

Mathematically:

Maximum Loss

Mathematically:

Breakeven Point

The breakeven point is the index level at which the gains from the put option exactly offset the premium paid. It occurs when the value of the index is equal to the strike price minus the premium paid.

Mathematically:

Example

Let’s say the S&P 500 is currently trading at 4,000, and you expect the index to decline in the next month. Here’s how you might execute a buying index put strategy:

Outcomes

Risk/Reward Profile

When to Buy

Pros

Cons

Example Summary

Buying index puts is a bearish options strategy used to profit from a decline in the value of an underlying index. It offers limited risk (the premium paid) and the potential for unlimited profit if the index falls significantly. This strategy is useful for speculating on market declines, hedging existing positions, or capitalizing on market volatility. However, the strategy requires careful timing, as the option’s value erodes over time, and the investor must anticipate a significant move before expiration to realize a profit.

Buying Index Calls is a straightforward and popular options trading strategy where an investor purchases a call option on an index (such as the S&P 500, Nasdaq-100, or any other financial index). A call option gives the buyer the right, but not the obligation, to buy the underlying asset (in this case, the index) at a specific strike price before or on the expiration date.

When buying an index call, the investor expects that the value of the underlying index will increase (rise) during the life of the option. The primary goal is to profit from price appreciation of the index while limiting the amount of capital at risk (since the risk is limited to the premium paid for the call option).

The main goal of buying index calls is to profit from a rise in the value of the index. If the value of the index increases significantly above the strike price, the investor can exercise the option (if the call option is in the money), or they can sell the option for a profit.

Unlike buying individual stocks, buying options on an index allows the investor to speculate on the overall direction of the market or a broad sector rather than a specific stock.

Maximum Profit

Mathematically:

Maximum Loss

Mathematically:

Breakeven Point

The breakeven point is the price level that the index needs to reach for the buyer to recoup the cost of the premium paid for the option. It is calculated by adding the premium paid for the call to the strike price of the option.

Mathematically:

Example

Let’s say you are interested in the S&P 500 Index (SPX), which is currently trading at 4,000. You believe that the S&P 500 will rise in the coming months. Here’s how you would buy an index call:

Outcomes

Risk/Reward Profile

Pros

Cons

Example Summary

Buying index calls is a bullish strategy that allows investors to profit from an expected rise in the value of an index. The strategy provides limited risk (the premium paid) and unlimited profit potential if the index rises above the strike price. It’s an effective tool for leveraging bullish market views, but the trade must be executed with careful attention to timing, volatility, and the overall market outlook to be successful.

The Bull Put Spread (also known as a Credit Put Spread) is an options trading strategy that is typically used when an investor has a moderately bullish outlook on an underlying asset. The strategy involves selling a put option at a higher strike price and buying a put option at a lower strike price, both with the same expiration date. This setup results in a net credit to the trader’s account, as the premium received from selling the higher strike put is greater than the premium paid for buying the lower strike put.

The Bull Put Spread is a limited-risk, limited-reward strategy that benefits when the price of the underlying asset stays above the strike price of the put option sold (the higher strike) and the options expire worthless.

The goal of a Bull Put Spread is to profit from a stable or moderately bullish move in the underlying asset’s price. The strategy profits when the price of the asset remains above the higher strike price of the sold put option, allowing both puts to expire worthless and the trader to keep the net premium received as profit.

This strategy is designed to limit risk (because the purchased put provides protection) while providing a defined, capped profit potential.

The combination of these two options results in a net credit, meaning the trader receives more money from selling the higher strike put than they pay for buying the lower strike put.

Maximum Profit

Mathematically

Maximum Loss

Mathematically

Breakeven Point

The breakeven point occurs when the price of the underlying asset is such that the profit from the premium received from the short put is exactly offset by the loss on the long put. It is calculated as the strike price of the sold put minus the net premium received.

Mathematically

Example

Let’s say a stock is currently trading at $100. The trader is moderately bullish and wants to create a Bull Put Spread:

Net Premium Received

Maximum Profit

The maximum profit occurs if the stock price remains above $95 at expiration (both options expire worthless).

Maximum Loss

The maximum loss occurs if the stock price falls below $90 at expiration.

Breakeven Point

The breakeven point occurs when the stock price is equal to the strike price of the sold put minus the net premium received.

Risk/Reward Profile

The reward-to-risk ratio can vary depending on the size of the premium received relative to the distance between the two strike prices.

Pros

Cons

Example Summary

The Bull Put Spread (or Credit Put Spread) is a limited-risk, limited-reward strategy used when a trader has a moderately bullish outlook on an underlying asset. It involves selling a higher strike put option and buying a lower strike put option, both with the same expiration date. The strategy benefits from a stable or rising market, with the potential to earn a net premium if the stock price stays above the strike price of the sold put. While the profit is capped, the strategy provides a defined risk and is an efficient way to generate income in moderately bullish market conditions.

The Bull Call Spread (also known as a Debit Call Spread) is a popular options trading strategy used when an investor has a bullish outlook on an underlying asset but wants to limit both the cost and the risk of the trade. The strategy involves buying a call option at a lower strike price and selling a call option at a higher strike price, both with the same expiration date.

This strategy is called a “debit spread” because the trader pays a net debit to enter the position, meaning the cost of buying the call option is higher than the premium received from selling the other call.

The main goal of a Bull Call Spread is to profit from a moderate increase in the price of the underlying asset while limiting both the cost of the trade and the risk. This is done by combining the purchase of a call (which gives unlimited upside potential) with the sale of a call (which offsets part of the cost of the trade, limiting risk).

Mechanics of the Trade

The key feature of the Bull Call Spread is that it allows you to capitalize on a moderate upward movement in the underlying asset’s price, but with limited risk.

Maximum Profit

Mathematically

Maximum Loss

Mathematically

Breakeven Point

The breakeven point occurs when the price of the underlying asset is such that the gains from the long call (the bought call) offset the cost of the trade (the net premium paid). This is calculated as the strike price of the long call plus the net premium paid.

Mathematically

Example

Let’s assume a stock is currently trading at $100. The trader expects the stock to rise moderately but wants to limit their risk.

Net Premium Paid

Maximum Profit

The maximum profit occurs if the stock price is at or above $110 at expiration.

Maximum Loss

The maximum loss occurs if the stock price is below $100 at expiration, as both options would expire worthless.

Breakeven Point

The breakeven point occurs when the stock price is equal to the strike price of the long call plus the net premium paid.

Risk/Reward Profile

When to Use

Pros

Cons

Example Summary

The Bull Call Spread (or Debit Call Spread) is a cost-effective, limited-risk options strategy for traders who are moderately bullish on an asset. It allows the trader to profit from a moderate upward move in the price of the underlying asset while controlling the potential loss. While the profit potential is capped, the strategy provides a balanced risk/reward profile and is well-suited for situations where you expect the underlying asset to rise, but not too dramatically.

The Bear Spread Spread, also known as a Double Bear Spread or Combination Bear Spread, is a sophisticated options strategy that combines elements of two Bear Spread strategies (typically a Bear Put Spread or Bear Call Spread) to create a position with multiple layers of risk and reward. While it’s not as commonly discussed as simpler spreads, it can be an effective tool in specific market conditions.

The goal of the Bear Spread Spread is to create a complex bearish position where the trader can take advantage of the moderate bearish movement of the underlying asset, while limiting risk exposure. This strategy is designed to allow the trader to capitalize on multiple levels of price movement, making it more flexible and potentially more profitable in a market with moderate volatility.

The strategy has limited profit potential but offers greater flexibility in structuring risk-reward scenarios, particularly if a trader believes the underlying asset will decline in stages or at varying rates over time.

Let’s break down a Double Bear Put Spread example:

Example Setup

Imagine you have a stock trading at $100. You are bearish on the stock and want to create a Double Bear Put Spread:

Net Premium Paid

Maximum Profit

Maximum Loss

Breakeven Points

Risk/Reward Profile

Pros

Cons

Example Summary

The Bear Spread Spread (or Double Bear Spread) is a more advanced options strategy that combines two separate Bear Spreads. It’s designed for a moderately bearish outlook and allows for more specific structuring of risk and reward. While the profit potential is capped, it provides flexibility in terms of managing risk over multiple time frames and price ranges. It is most useful in markets where you expect the price of the underlying asset to decline gradually and moderately over time.

A Bear Put Spread is an options trading strategy used when an investor has a bearish outlook on the underlying asset, but wants to limit both the risk and the cost of the trade. It involves buying a put option at a higher strike price and simultaneously selling a put option at a lower strike price, both with the same expiration date.

The strategy benefits from a decline in the underlying asset’s price. The idea is that the price will fall enough for the purchased (long) put to gain value, while the sold (short) put will lose value, but the net loss is limited by the premium collected from the sale.

The goal of a Bear Put Spread is to profit from a decrease in the price of the underlying asset while limiting both the potential loss and the cost of entering the trade. This strategy is typically used when an investor expects the price of the asset to drop but does not anticipate a large move downward.

Maximum Profit

Maximum Loss

Breakeven Point

The breakeven point is the price at which the total value of the position is zero, meaning the profit from the long put is exactly offset by the loss on the short put. The breakeven point is calculated as the higher strike price minus the net premium paid.

Mathematically

Example

Let’s consider an example using a stock currently trading at $100.

Net Premium Paid

Maximum Profit

The maximum profit occurs if the stock price falls below $95 at expiration.

Maximum Loss

The maximum loss occurs if the stock price is above $100 at expiration.

Breakeven Point

The breakeven point is the strike price of the long put minus the net premium paid.

Risk/Reward Profile

Pros

Cons

Example Summary

The Bear Put Spread is a strategy that is ideal for bearish traders who want to limit their risk exposure while still profiting from a moderate drop in the underlying asset’s price. It is a more affordable alternative to simply buying a put option, and its risk and reward are both defined and manageable. However, its profit potential is capped, and it requires the price to decline moderately for maximum profitability.

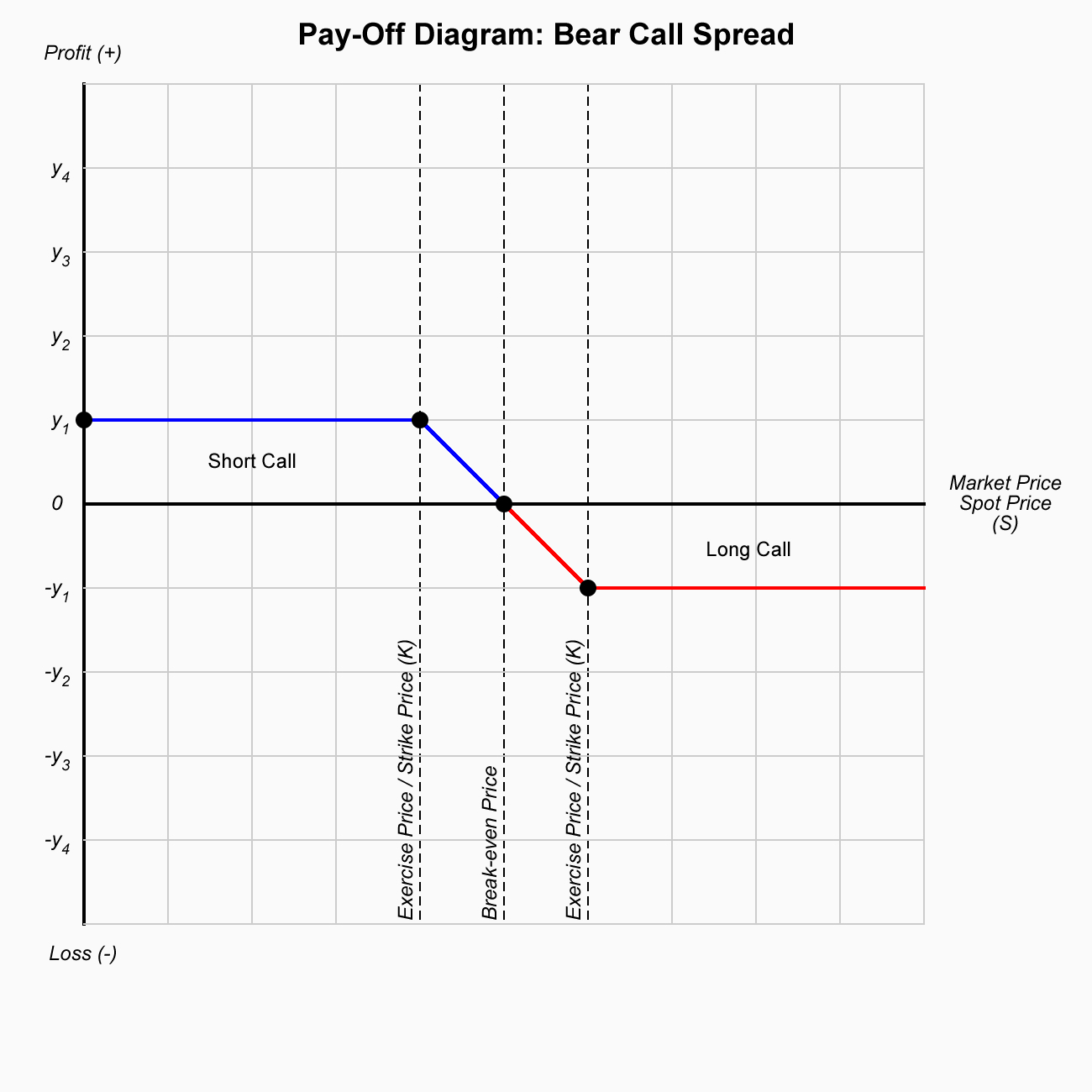

A Bear Call Spread (also known as a Credit Call Spread) is an options trading strategy used when an investor has a neutral to bearish outlook on the underlying asset. This strategy involves selling a call option at a lower strike price and simultaneously buying a call option at a higher strike price, both with the same expiration date.

The primary goal of the bear call spread is to generate income through the premium collected from selling the lower strike call option while limiting risk by purchasing the higher strike call option.

Since the strategy is ‘bearish’, it is profitable when the price of the underlying asset remains below the strike price of the call option that was sold (the lower strike), ideally staying as low as possible.

Maximum Profit

Maximum Loss

Breakeven Point

The breakeven point for the trade is calculated by adding the net premium received to the strike price of the short call. Mathematically:

Example

Let’s consider an example using a stock trading at $100:

Net Premium Received

Maximum Profit

The maximum profit occurs if the stock stays below $105 at expiration.

Maximum Loss

The maximum loss occurs if the stock rises above $110 at expiration.

Breakeven Point

The breakeven point is the strike price of the short call plus the net premium received.

Risk/Reward Profile:

Usage

Pros

Cons

The Bear Call Spread is a popular options strategy for those with a neutral to slightly bearish outlook, as it allows traders to collect premium income while limiting downside risk. However, its profit potential is capped, and it requires careful management to avoid significant losses if the price of the underlying asset increases significantly.

The Three Outside Down is a bearish reversal candlestick pattern that appears at the top of an uptrend. It signals a potential trend reversal, indicating that the market is likely to transition from an uptrend to a downtrend. This pattern consists of three candlesticks and is often used by traders to identify entry points for short positions (selling).

The Three Outside Down is part of the “Outside” family of candlestick patterns, which also includes the Three Outside Up pattern (a bullish reversal pattern). The key characteristic of the Three Outside Down is that it shows a strong shift in momentum, where bears overpower the bulls, resulting in a bearish reversal.

The Three Outside Down pattern is composed of three candlesticks, and it typically forms at the top of a bullish trend or after a significant rally in price. The pattern consists of the following components:

First Candle: A Bullish Candle

Second Candle: A Large Bearish Candle

Third Candle: Continuation of Bearish Momentum

Here’s a diagram that visually shows how the Three Outside Down pattern typically looks:

┌─────────────────────┐

│ Bullish │

│ (Small Green) │

└─────────────────────┘

┌─────────────────────┐

│ Bearish │

│ (Large Red) │

└─────────────────────┘

┌─────────────────────┐

│ Bearish │

│ (Large Red) │

└─────────────────────┘

To ensure that the Three Outside Down pattern is valid, the following key features should be observed:

First Candle (Bullish Candle)

Second Candle (Large Bearish Candle)

Third Candle (Bearish Continuation)

The Three Outside Down pattern signals a reversal of an uptrend and indicates that the market is likely to enter a downtrend. Here’s how to interpret the pattern:

The Three Outside Down pattern is typically used by traders to enter a short position (selling) in anticipation of a bearish move. Here’s how to trade the pattern effectively:

Entry

Stop Loss

Take Profit

Risk Management

While the Three Outside Down pattern is a powerful signal on its own, traders often look for additional confirmation to improve the accuracy of their trade:

Like any candlestick pattern, the Three Outside Down has its limitations:

The Three Outside Down pattern is a powerful candlestick pattern that indicates a bearish reversal at the top of an uptrend. It consists of three candles:

This pattern is used by traders to identify potential short entry points, betting on the continuation of the downtrend. Proper confirmation through volume, trend indicators, and other momentum tools can increase the reliability of the pattern.

As always, it’s crucial to use appropriate risk management when trading with candlestick patterns and to combine them with other technical analysis tools to increase the chances of success.