| Rank | Country | Institution |

|---|---|---|

| 1 | Singapore | Temasek Holdings |

| 2 | Singapore | GIC Private Limited |

| 3 | Canada | CPP Investments |

| 4 | United Arab Emirates | Mubadala Investment Company |

| 5 | United Arab Emirates | Abu Dhabi Investment Authority (ADIA) |

| 6 | US | California Public Employees' Retirement System |

| 7 | China | China Life Insurance Company |

| 8 | Canada | La Caisse |

| 9 | Netherlands | APG Asset Management |

| 10 | Hong Kong | Hong Kong Monetary Authority |

| 11 | US | California State Teachers' Retirement System |

| 12 | South Korea | National Pension Service of Korea (NPS) |

| 13 | US | Washington State Investment Board |

| 14 | Japan | Japan Post Bank |

| 15 | Canada | Ontario Teachers' Pension Plan |

| 16 | US | New York State Common Retirement Fund |

| 17 | US | Teacher Retirement System of Texas |

| 18 | France | BPI France |

| 19 | Canada | Public Sector Pension Investment Board |

| 20 | US | Oregon State Treasury |

| 21 | Germany | Allianz Group |

| 22 | US | Harvard Management Company |

| 23 | US | State of Michigan Retirement Systems |

| 24 | Canada | BCI |

| 25 | Netherlands | Pensioenfonds Zorg en Welzijn |

| 26 | US | State of Wisconsin Investment Board |

| 27 | US | Yale University |

| 28 | Australia | Australia Future Fund |

| 29 | Canada | Ontario Municipal Employees Retirement System |

| 30 | US | Virginia Retirement System |

| 31 | US | MetLife |

| 32 | France | AXA Group |

| 33 | US | State Board of Administration of Florida |

| 34 | US | Massachusetts Pension Reserves Investment Management Board |

| 35 | US | UC Investments |

| 36 | US | Stanford Management Company (SMC) |

| 37 | Denmark | Novo Holdings A/S |

| 38 | Canada | Healthcare of Ontario Pension Plan |

| 39 | US | Minnesota State Board of Investment |

| 40 | China | Ping An Life Insurance |

| 41 | US | The University of Texas/Texas A&M Investment Management Company |

| 42 | South Korea | Korea Investment Corporation (KIC) |

| 43 | UK | The Wellcome Trust |

| 44 | US | Ohio Public Employees Retirement System |

| 45 | US | Maryland State Retirement and Pension System |

| 46 | US | Alaska Permanent Fund |

| 47 | Germany | Bayerische Versorgungskammer (BVK) |

| 48 | US | TIAA |

| 49 | Italy | Assicurazioni Generali |

| 50 | US | New York State Teachers' Retirement System |

| 51 | US | Princeton University Investment Co. |

| 52 | Denmark | PKA |

| 53 | US | Los Angeles County Employees' Retirement Association |

| 54 | US | Texas County and District Retirement System |

| 55 | Canada | Manulife Financial |

| 56 | Australia | Australian Retirement Trust |

| 57 | Finland | Finnish Local Government Pensions Institution (KEVA) |

| 58 | US | Teachers' Retirement System of the State of Illinois |

| 59 | Malaysia | Employees Provident Fund of Malaysia |

| 60 | Netherlands | MN |

| 61 | US | Prudential Financial Inc. |

| 62 | US | Pennsylvania Public School Employees' Retirement System |

| 63 | US | Massachusetts Institute of Technology |

| 64 | US | University of Notre Dame |

| 65 | Switzerland | Chubb Limited |

| 66 | Australia | AustralianSuper |

| 67 | US | San Francisco Employees' Retirement System |

| 68 | Canada | Alberta Investment Management Corporation |

| 69 | US | Public School and Education Employee Retirement Systems of Missouri |

| 70 | Finland | Varma Mutual Pension Insurance Company |

| 71 | US | New York City Employees' Retirement System |

| 72 | US | International Finance Corporation |

| 73 | US | State Teachers' Retirement System of Ohio |

| 74 | US | Texas Permanent School Fund |

| 75 | US | Teachers' Retirement System of the City of New York |

| 76 | Sweden | Skandia Mutual Life Insurance Company |

| 77 | US | Tennessee Consolidated Retirement System |

| 78 | US | University of Pennsylvania |

| 79 | Netherlands | Royal Dutch Shell Pension Fund |

| 80 | US | United Nations Joint Staff Pension Fund |

| 81 | US | International Bank for Reconstruction and Development Pension Fund |

| 82 | US | Iowa Public Employees' Retirement System |

| 83 | US | University of Michigan |

| 84 | Finland | Ilmarinen Mutual Pension Insurance Company |

| 85 | US | Washington University Investment Management Company |

| 86 | US | New Jersey Division of Investment |

| 87 | South Korea | Korean Teachers' Credit Union (KTCU) |

| 88 | US | Arizona State Retirement System |

| 89 | UK | Universities Superannuation Scheme (USS) |

| 90 | US | Allstate Investments |

| 91 | US | Howard Hughes Medical Institute |

| 92 | Australia | Aware Super |

| 93 | US | Employees Retirement System of Texas |

| 94 | US | Connecticut Retirement Plans and Trust Funds |

| 95 | US | GE Pension Plan |

| 96 | Sweden | AP Fonden 6 |

| 97 | Japan | Pension Fund Association (Japan) |

| 98 | US | Pennsylvania State Employees' Retirement System |

| 99 | Germany | MEAG |

| 100 | Canada | Investment Management Corporation of Ontario |

| 101 | US | South Carolina Retirement System |

| 102 | US | North Carolina State Treasury |

| 103 | Taiwan | Fubon Life Insurance |

| 104 | US | New York City Police Pension Fund |

| 105 | Australia | Hostplus |

| 106 | US | Illinois Municipal Retirement Fund |

| 107 | Finland | Elo Mutual Insurance Company |

| 108 | Switzerland | Suva |

| 109 | Denmark | ATP |

| 110 | Australia | QIC Limited |

| 111 | US | Teachers' Retirement System of Louisiana |

| 112 | US | Utah Retirement Systems |

| 113 | US | Texas Municipal Retirement System |

| 114 | Taiwan | Cathay Life Insurance |

| 115 | US | Los Angeles Fire & Police Pension System |

| 116 | Sweden | AP Fonden 2 |

| 117 | US | UPS Pension Fund |

| 118 | US | AT&T Pension Fund |

| 119 | US | Colorado Public Employees' Retirement Association |

| 120 | US | Alaska Retirement Management Board |

| 121 | South Africa | Government Employees Pension Fund |

| 122 | US | New Mexico State Investment Council |

| 123 | US | Raytheon Technologies Corporation Pension Fund |

| 124 | US | Public Employees' Retirement System of Nevada |

| 125 | Taiwan | Nan Shan Life Insurance |

| 126 | US | Lockheed Martin Corporation Pension Fund |

| 127 | US | Northwestern University Investment Office |

| 128 | Australia | MLC Asset Management |

| 129 | US | Los Angeles City Employees' Retirement System |

| 130 | US | Indiana Public Retirement System |

| 131 | US | The University of North Carolina at Chapel Hill |

| 132 | Germany | Talanx Group |

| 133 | US | Employees' Retirement System of the State of Hawaii |

| 134 | US | William and Flora Hewlett Foundation |

| 135 | France | Caisse des Depots et Consignations |

| 136 | Japan | Government Pension Investment Fund, Japan (GPIF) |

| 137 | US | Eli Lilly & Company Pension Fund |

| 138 | Denmark | Industriens Pension |

| 139 | Switzerland | Swiss Reinsurance Company |

| 140 | US | Vanderbilt University |

| 141 | Denmark | PensionDanmark |

| 142 | Sweden | AP Fonden 3 |

| 143 | US | University of Virginia Investment Management Company (UVIMCO) |

| 144 | US | Boeing Company Pension Fund |

| 145 | US | Public Employees' Retirement System of Mississippi |

| 146 | US | Orange County Employees Retirement System |

| 147 | US | New Mexico Educational Retirement Board |

| 148 | US | The Church Pension Group |

| 149 | US | Emory University |

| 150 | Canada | OPTrust |

| Index | Category | Function | Description | Formula |

|---|---|---|---|---|

| 1 | Add-in and Automation | CALL | Calls a procedure in a dynamic link library or code resource. | |

| 2 | Add-in and Automation | EUROCONVERT | Converts a number to euros, converts a number from euros to a euro member currency, or converts a number from one euro member currency to another by using the euro as an intermediary (triangulation). | |

| 3 | Add-in and Automation | REGISTER.ID | Returns the register ID of the specified dynamic link library (DLL) or code resource that has been previously registered. | |

| 4 | Compatibility | BETADIST | Returns the beta cumulative distribution function. | |

| 5 | Compatibility | BETAINV | Returns the inverse of the cumulative distribution function for a specified beta distribution. | |

| 6 | Compatibility | BINOMDIST | Returns the individual term binomial distribution probability. | |

| 7 | Compatibility | CEILING | Rounds a number to the nearest integer or to the nearest multiple of significance. | |

| 8 | Compatibility | CHIDIST | Returns the one-tailed probability of the chi-squared distribution. | |

| 9 | Compatibility | CHIINV | Returns the inverse of the one-tailed probability of the chi-squared distribution. | |

| 10 | Compatibility | CHITEST | Returns the test for independence. | |

| 11 | Compatibility | CONFIDENCE | Returns the confidence interval for a population mean. | |

| 12 | Compatibility | COVAR | Returns covariance, the average of the products of paired deviations. | |

| 13 | Compatibility | CRITBINOM | Returns the smallest value for which the cumulative binomial distribution is less than or equal to a criterion value. | |

| 14 | Compatibility | EXPONDIST | Returns the exponential distribution. | |

| 15 | Compatibility | FDIST | Returns the F probability distribution. | |

| 16 | Compatibility | FINV | Returns the inverse of the F probability distribution. | |

| 17 | Compatibility | FLOOR | Rounds a number down, toward zero. | |

| 18 | Compatibility | FTEST | Returns the result of an F-test. | |

| 19 | Compatibility | GAMMADIST | Returns the gamma distribution. | |

| 20 | Compatibility | GAMMAINV | Returns the inverse of the gamma cumulative distribution. | |

| 21 | Compatibility | HYPGEOMDIST | Returns the hypergeometric distribution. | |

| 22 | Compatibility | LOGINV | Returns the inverse of the lognormal cumulative distribution. | |

| 23 | Compatibility | LOGNORMDIST | Returns the cumulative lognormal distribution. | |

| 24 | Compatibility | MODE | Returns the most common value in a data set. | |

| 25 | Compatibility | NEGBINOMDIST | Returns the negative binomial distribution. | |

| 26 | Compatibility | NORM.INV | Returns the inverse of the normal cumulative distribution. | |

| 27 | Compatibility | NORMDIST | Returns the normal cumulative distribution. | |

| 28 | Compatibility | NORMSDIST | Returns the standard normal cumulative distribution. | |

| 29 | Compatibility | NORMSINV | Returns the inverse of the standard normal cumulative distribution. | |

| 30 | Compatibility | PERCENTILE | Returns the k-th percentile of values in a range. | |

| 31 | Compatibility | PERCENTRANK | Returns the percentage rank of a value in a data set. | |

| 32 | Compatibility | POISSON | Returns the Poisson distribution. | |

| 33 | Compatibility | QUARTILE | Returns the quartile of a data set. | |

| 34 | Compatibility | RANK | Returns the rank of a number in a list of numbers. | |

| 35 | Compatibility | STDEV | Estimates standard deviation based on a sample. | =STDEV(number1,[number2],...) |

| 36 | Compatibility | STDEV.P | Calculates standard deviation based on the entire population. | =STDEV.P(number1,[number2],...) |

| 37 | Compatibility | STDEV.S | Calculates standard deviation based on the sample. | =STDEV.S(number1,[number2],...) |

| 38 | Compatibility | TDIST | Returns the Student's t-distribution. | |

| 39 | Compatibility | TINV | Returns the inverse of the Student's t-distribution. | |

| 40 | Compatibility | TTEST | Returns the probability associated with a Student's t-test. | |

| 41 | Compatibility | VAR | Estimates variance based on a sample. | |

| 42 | Compatibility | VARP | Calculates variance based on the entire population. | |

| 43 | Compatibility | WEIBULL | Calculates variance based on the entire population, including numbers, text, and logical values. | |

| 44 | Compatibility | ZTEST | Returns the one-tailed probability-value of a z-test. | |

| 45 | Cube | CUBEKPIMEMBER | Returns a key performance indicator (KPI) name, property, and measure, and displays the name and property in the cell. A KPI is a quantifiable measurement, such as monthly gross profit or quarterly employee turnover, used to monitor an organization's performance. | |

| 46 | Cube | CUBEMEMBER | Returns a member or tuple in a cube hierarchy. Use to validate that the member or tuple exists in the cube. | |

| 47 | Cube | CUBEMEMBERPROPERTY | Returns the value of a member property in the cube. Use to validate that a member name exists within the cube and to return the specified property for this member. | |

| 48 | Cube | CUBERANKEDMEMBER | Returns the nth, or ranked, member in a set. Use to return one or more elements in a set, such as the top sales performer or top 10 students. | |

| 49 | Cube | CUBESET | Defines a calculated set of members or tuples by sending a set expression to the cube on the server, which creates the set, and then returns that set to Microsoft Office Excel. | |

| 50 | Cube | CUBESETCOUNT | Returns the number of items in a set. | |

| 51 | Cube | CUBEVALUE | Returns an aggregated value from a cube. | |

| 52 | Database | DAVERAGE | Returns the average of selected database entries. | |

| 53 | Database | DCOUNT | Counts the cells that contain numbers in a database. | |

| 54 | Database | DCOUNTA | Counts nonblank cells in a database. | |

| 55 | Database | DGET | Extracts from a database a single record that matches the specified criteria. | |

| 56 | Database | DMAX | Returns the maximum value from selected database entries. | |

| 57 | Database | DMIN | Returns the minimum value from selected database entries. | |

| 58 | Database | DPRODUCT | Multiplies the values in a particular field of records that match the criteria in a database. | |

| 59 | Database | DSTDEV | Estimates the standard deviation based on a sample of selected database entries. | |

| 60 | Database | DSTDEVP | Calculates the standard deviation based on the entire population of selected database entries. | |

| 61 | Database | DSUM | Adds the numbers in the field column of records in the database that match the criteria. | |

| 62 | Database | DVAR | Estimates variance based on a sample from selected database entries. | |

| 63 | Database | DVARP | Calculates variance based on the entire population of selected database entries. | |

| 64 | Date and Time | DATE | Returns the serial number of a particular date. | |

| 65 | Date and Time | DATEDIF | Calculates the number of days, months, or years between two dates. This function is useful in formulas where you need to calculate an age. | |

| 66 | Date and Time | DATEVALUE | Converts a date in the form of text to a serial number. | |

| 67 | Date and Time | DAY | Converts a serial number to a day of the month. | |

| 68 | Date and Time | DAYS | Returns the number of days between two dates. | |

| 69 | Date and Time | DAYS360 | Calculates the number of days between two dates based on a 360-day year. | |

| 70 | Date and Time | EDATE | Returns the serial number of the date that is the indicated number of months before or after the start date. | |

| 71 | Date and Time | EOMONTH | Returns the serial number of the last day of the month before or after a specified number of months. | |

| 72 | Date and Time | HOUR | Converts a serial number to an hour. | |

| 73 | Date and Time | ISOWEEKNUM | Returns the number of the ISO week number of the year for a given date. | |

| 74 | Date and Time | MINUTE | Converts a serial number to a minute. | |

| 75 | Date and Time | MONTH | Converts a serial number to a month. | |

| 76 | Date and Time | NETWORKDAYS | Returns the number of whole workdays between two dates. | |

| 77 | Date and Time | NETWORKDAYS.INTL | Returns the number of whole workdays between two dates using parameters to indicate which and how many days are weekend days. | |

| 78 | Date and Time | NOW | Returns the serial number of the current date and time. | |

| 79 | Date and Time | SECOND | Converts a serial number to a second. | |

| 80 | Date and Time | TIME | Returns the serial number of a particular time. | |

| 81 | Date and Time | TIMEVALUE | Converts a time in the form of text to a serial number. | |

| 82 | Date and Time | TODAY | Returns the serial number of today's date. | |

| 83 | Date and Time | WEEKDAY | Converts a serial number to a day of the week. | |

| 84 | Date and Time | WEEKNUM | Converts a serial number to a number representing where the week falls numerically with a year. | |

| 85 | Date and Time | WORKDAY | Returns the serial number of the date before or after a specified number of workdays. | |

| 86 | Date and Time | WORKDAY.INTL | Returns the serial number of the date before or after a specified number of workdays using parameters to indicate which and how many days are weekend days. | |

| 87 | Date and Time | YEAR | Converts a serial number to a year. | |

| 88 | Date and Time | YEARFRAC | Returns the year fraction representing the number of whole days between start_date and end_date. | |

| 89 | Engineering | BESSELI | Returns the modified Bessel function In(x). | |

| 90 | Engineering | BESSELJ | Returns the Bessel function Jn(x). | |

| 91 | Engineering | BESSELK | Returns the modified Bessel function Kn(x). | |

| 92 | Engineering | BESSELY | Returns the Bessel function Yn(x). | |

| 93 | Engineering | BIN2DEC | Converts a binary number to decimal. | |

| 94 | Engineering | BIN2HEX | Converts a binary number to hexadecimal. | |

| 95 | Engineering | BIN2OCT | Converts a binary number to octal. | |

| 96 | Engineering | BITAND | Returns a 'Bitwise And' of two numbers. | |

| 97 | Engineering | BITLSHIFT | Returns a value number shifted left by shift_amount bits. | |

| 98 | Engineering | BITOR | Returns a bitwise OR of 2 numbers. | |

| 99 | Engineering | BITRSHIFT | Returns a value number shifted right by shift_amount bits. | |

| 100 | Engineering | BITXOR | Returns a bitwise 'Exclusive Or' of two numbers. | |

| 101 | Engineering | COMPLEX | Converts real and imaginary coefficients into a complex number. | |

| 102 | Engineering | CONVERT | Converts a number from one measurement system to another. | |

| 103 | Engineering | DEC2BIN | Converts a decimal number to binary. | |

| 104 | Engineering | DEC2HEX | Converts a decimal number to hexadecimal. | |

| 105 | Engineering | DEC2OCT | Converts a decimal number to octal. | |

| 106 | Engineering | DELTA | Tests whether two values are equal. | |

| 107 | Engineering | ERF | Returns the error function. | |

| 108 | Engineering | ERF.PRECISE | Returns the error function. | |

| 109 | Engineering | ERFC | Returns the complementary error function. | |

| 110 | Engineering | ERFC.PRECISE | Returns the complementary ERF function integrated between x and infinity. | |

| 111 | Engineering | GESTEP | Tests whether a number is greater than a threshold value. | |

| 112 | Engineering | HEX2BIN | Converts a hexadecimal number to binary. | |

| 113 | Engineering | HEX2DEC | Converts a hexadecimal number to decimal. | |

| 114 | Engineering | HEX2OCT | Converts a hexadecimal number to octal. | |

| 115 | Engineering | IMABS | Returns the absolute value (modulus) of a complex number. | |

| 116 | Engineering | IMAGINARY | Returns the imaginary coefficient of a complex number. | |

| 117 | Engineering | IMARGUMENT | Returns the argument theta, an angle expressed in radians. | |

| 118 | Engineering | IMCONJUGATE | Returns the complex conjugate of a complex number. | |

| 119 | Engineering | IMCOS | Returns the cosine of a complex number. | |

| 120 | Engineering | IMCOSH | Returns the hyperbolic cosine of a complex number. | |

| 121 | Engineering | IMCOT | Returns the cotangent of a complex number. | |

| 122 | Engineering | IMCSC | Returns the cosecant of a complex number. | |

| 123 | Engineering | IMCSCH | Returns the hyperbolic cosecant of a complex number. | |

| 124 | Engineering | IMDIV | Returns the quotient of two complex numbers. | |

| 125 | Engineering | IMEXP | Returns the exponential of a complex number. | |

| 126 | Engineering | IMLN | Returns the natural logarithm of a complex number. | |

| 127 | Engineering | IMLOG10 | Returns the base-10 logarithm of a complex number. | |

| 128 | Engineering | IMLOG2 | Returns the base-2 logarithm of a complex number. | |

| 129 | Engineering | IMPOWER | Returns a complex number raised to an integer power. | |

| 130 | Engineering | IMPRODUCT | Returns the product of complex numbers. | |

| 131 | Engineering | IMREAL | Returns the real coefficient of a complex number. | |

| 132 | Engineering | IMSEC | Returns the secant of a complex number. | |

| 133 | Engineering | IMSECH | Returns the hyperbolic secant of a complex number. | |

| 134 | Engineering | IMSIN | Returns the sine of a complex number. | |

| 135 | Engineering | IMSINH | Returns the hyperbolic sine of a complex number. | |

| 136 | Engineering | IMSQRT | Returns the square root of a complex number. | |

| 137 | Engineering | IMSUB | Returns the difference between two complex numbers. | |

| 138 | Engineering | IMSUM | Returns the sum of complex numbers. | |

| 139 | Engineering | IMTAN | Returns the tangent of a complex number. | |

| 140 | Engineering | OCT2BIN | Converts an octal number to binary. | |

| 141 | Engineering | OCT2DEC | Converts an octal number to decimal. | |

| 142 | Engineering | OCT2HEX | Converts an octal number to hexadecimal. | |

| 143 | Financial | ACCRINT | Returns the accrued interest for a security that pays periodic interest. | |

| 144 | Financial | ACCRINTM | Returns the accrued interest for a security that pays interest at maturity. | |

| 145 | Financial | AMORDEGRC | Returns the depreciation for each accounting period by using a depreciation coefficient. | |

| 146 | Financial | AMORLINC | Returns the depreciation for each accounting period. | |

| 147 | Financial | COUPDAYBS | Returns the number of days from the beginning of the coupon period to the settlement date. | |

| 148 | Financial | COUPDAYS | Returns the number of days in the coupon period that contains the settlement date. | |

| 149 | Financial | COUPDAYSNC | Returns the number of days from the settlement date to the next coupon date. | |

| 150 | Financial | COUPNCD | Returns the next coupon date after the settlement date. | |

| 151 | Financial | COUPNUM | Returns the number of coupons payable between the settlement date and maturity date. | |

| 152 | Financial | COUPPCD | Returns the previous coupon date before the settlement date. | |

| 153 | Financial | CUMIPMT | Returns the cumulative interest paid between two periods. | |

| 154 | Financial | CUMPRINC | Returns the cumulative principal paid on a loan between two periods. | |

| 155 | Financial | DB | Returns the depreciation of an asset for a specified period by using the fixed-declining balance method. | |

| 156 | Financial | DDB | Returns the depreciation of an asset for a specified period by using the double-declining balance method or some other method that you specify. | |

| 157 | Financial | DISC | Returns the discount rate for a security. | |

| 158 | Financial | DOLLARDE | Converts a dollar price, expressed as a fraction, into a dollar price, expressed as a decimal number. | |

| 159 | Financial | DOLLARFR | Converts a dollar price, expressed as a decimal number, into a dollar price, expressed as a fraction. | |

| 160 | Financial | DURATION | Returns the annual duration of a security with periodic interest payments. | |

| 161 | Financial | EFFECT | Returns the effective annual interest rate. | |

| 162 | Financial | FV | Returns the future value of an investment. | |

| 163 | Financial | FVSCHEDULE | Returns the future value of an initial principal after applying a series of compound interest rates. | |

| 164 | Financial | INTRATE | Returns the interest rate for a fully invested security. | |

| 165 | Financial | IPMT | Returns the interest payment for an investment for a given period. | |

| 166 | Financial | IRR | Returns the internal rate of return for a series of cash flows. | |

| 167 | Financial | ISPMT | Calculates the interest paid during a specific period of an investment. | |

| 168 | Financial | MDURATION | Returns the Macauley modified duration for a security with an assumed par value of $100. | |

| 169 | Financial | MIRR | Returns the internal rate of return where positive and negative cash flows are financed at different rates. | |

| 170 | Financial | NOMINAL | Returns the annual nominal interest rate. | |

| 171 | Financial | NPER | Returns the number of periods for an investment. | |

| 172 | Financial | NPV | Returns the net present value of an investment based on a series of periodic cash flows and a discount rate. | |

| 173 | Financial | ODDFPRICE | Returns the price per $100 face value of a security with an odd first period. | |

| 174 | Financial | ODDFYIELD | Returns the yield of a security with an odd first period. | |

| 175 | Financial | ODDLPRICE | Returns the price per $100 face value of a security with an odd last period. | |

| 176 | Financial | ODDLYIELD | Returns the yield of a security with an odd last period. | |

| 177 | Financial | PDURATION | Returns the number of periods required by an investment to reach a specified value. | |

| 178 | Financial | PMT | Returns the periodic payment for an annuity. | |

| 179 | Financial | PPMT | Returns the payment on the principal for an investment for a given period. | |

| 180 | Financial | PRICE | Returns the price per $100 face value of a security that pays periodic interest. | |

| 181 | Financial | PRICEDISC | Returns the price per $100 face value of a discounted security. | |

| 182 | Financial | PRICEMAT | Returns the price per $100 face value of a security that pays interest at maturity. | |

| 183 | Financial | PV | Returns the present value of an investment. | |

| 184 | Financial | RATE | Returns the interest rate per period of an annuity. | |

| 185 | Financial | RECEIVED | Returns the amount received at maturity for a fully invested security. | |

| 186 | Financial | RRI | Returns an equivalent interest rate for the growth of an investment. | |

| 187 | Financial | SLN | Returns the straight-line depreciation of an asset for one period. | |

| 188 | Financial | SYD | Returns the sum-of-years' digits depreciation of an asset for a specified period. | |

| 189 | Financial | TBILLEQ | Returns the bond-equivalent yield for a Treasury bill. | |

| 190 | Financial | TBILLPRICE | Returns the price per $100 face value for a Treasury bill. | |

| 191 | Financial | TBILLYIELD | Returns the yield for a Treasury bill. | |

| 192 | Financial | VDB | Returns the depreciation of an asset for a specified or partial period by using a declining balance method. | |

| 193 | Financial | XIRR | Returns the internal rate of return for a schedule of cash flows that is not necessarily periodic. | |

| 194 | Financial | XNPV | Returns the net present value for a schedule of cash flows that is not necessarily periodic. | |

| 195 | Financial | YIELD | Returns the yield on a security that pays periodic interest. | |

| 196 | Financial | YIELDDISC | Returns the annual yield for a discounted security; for example, a Treasury bill. | |

| 197 | Financial | YIELDMAT | Returns the annual yield of a security that pays interest at maturity. | |

| 198 | Information | CELL | Returns information about the formatting, location, or contents of a cell. | |

| 199 | Information | ERROR.TYPE | Returns a number corresponding to an error type. | |

| 200 | Information | INFO | Returns information about the current operating environment. | |

| 201 | Information | ISBLANK | Returns TRUE if the value is blank. | |

| 202 | Information | ISERR | Returns TRUE if the value is any error value except #N/A. | |

| 203 | Information | ISERROR | Returns TRUE if the value is any error value. | |

| 204 | Information | ISEVEN | Returns TRUE if the number is even. | |

| 205 | Information | ISFORMULA | Returns TRUE if there is a reference to a cell that contains a formula. | |

| 206 | Information | ISLOGICAL | Returns TRUE if the value is a logical value. | |

| 207 | Information | ISNA | Returns TRUE if the value is the #N/A error value. | |

| 208 | Information | ISNONTEXT | Returns TRUE if the value is not text. | |

| 209 | Information | ISNUMBER | Returns TRUE if the value is a number. | |

| 210 | Information | ISODD | Returns TRUE if the number is odd. | |

| 211 | Information | ISOMITTED | Checks whether the value in a LAMBDA is missing and returns TRUE or FALSE. | |

| 212 | Information | ISREF | Returns TRUE if the value is a reference. | |

| 213 | Information | ISTEXT | Returns TRUE if the value is text. | |

| 214 | Information | N | Returns a value converted to a number. | |

| 215 | Information | NA | Returns the error value #N/A. | |

| 216 | Information | SHEET | Returns the sheet number of the referenced sheet. | |

| 217 | Information | SHEETS | Returns the number of sheets in a reference. | |

| 218 | Information | STOCKHISTORY | Retrieves historical data about a financial instrument. | |

| 219 | Information | STOCKHISTORY | Retrieves historical data about a financial instrument and loads it as an array. | |

| 220 | Information | TYPE | Returns a number indicating the data type of a value. | |

| 221 | Logical | AND | Returns TRUE if all of its arguments are TRUE. | |

| 222 | Logical | BYCOL | Applies a LAMBDA to each column and returns an array of the results. | |

| 223 | Logical | BYROW | Applies a LAMBDA to each row and returns an array of the results. | |

| 224 | Logical | IF | Specifies a logical test to perform. | |

| 225 | Logical | IFERROR | Returns a value you specify if a formula evaluates to an error; otherwise, returns the result of the formula. | |

| 226 | Logical | IFNA | Returns the value you specify if the expression resolves to #N/A, otherwise returns the result of the expression. | |

| 227 | Logical | IFS | Checks whether one or more conditions are met and returns a value that corresponds to the first TRUE condition. | |

| 228 | Logical | LAMBDA | Create custom, reusable and call them by a friendly name. | |

| 229 | Logical | LET | Assigns names to calculation results. | |

| 230 | Logical | MAKEARRAY | Returns a calculated array of a specified row and column size, by applying a LAMBDA. | |

| 231 | Logical | MAP | Returns an array formed by mapping each value in the array(s) to a new value by applying a LAMBDA to create a new value. | |

| 232 | Logical | NOT | Reverses the logic of its argument. | |

| 233 | Logical | OR | Returns TRUE if any argument is TRUE. | |

| 234 | Logical | REDUCE | Reduces an array to an accumulated value by applying a LAMBDA to each value and returning the total value in the accumulator. | |

| 235 | Logical | SCAN | Scans an array by applying a LAMBDA to each value and returns an array that has each intermediate value. | |

| 236 | Logical | SWITCH | Evaluates an expression against a list of values and returns the result corresponding to the first matching value. If there is no match, an optional default value may be returned. | |

| 237 | Logical | XOR | Returns a logical exclusive OR of all arguments. | |

| 238 | Logical | Returns the logical value FALSE. | ||

| 239 | Logical | 1 | Returns the logical value TRUE. | |

| 240 | Look and Reference | VSTACK | Appends arrays vertically and in sequence to return a larger array. | |

| 241 | Look and Reference | WRAPCOLS | Wraps the provided row or column of values by columns after a specified number of elements. | |

| 242 | Look and Reference | WRAPROWS | Wraps the provided row or column of values by rows after a specified number of elements. | |

| 243 | Lookup and Reference | ADDRESS | Returns a reference as text to a single cell in a worksheet. | |

| 244 | Lookup and Reference | AREAS | Returns the number of areas in a reference. | |

| 245 | Lookup and Reference | CHOOSE | Chooses a value from a list of values. | |

| 246 | Lookup and Reference | CHOOSECOLS | Returns the specified columns from an array. | |

| 247 | Lookup and Reference | CHOOSEROWS | Returns the specified rows from an array. | |

| 248 | Lookup and Reference | COLUMN | Returns the column number of a reference. | |

| 249 | Lookup and Reference | COLUMNS | Returns the number of columns in a reference. | |

| 250 | Lookup and Reference | DROP | Excludes a specified number of rows or columns from the start or end of an array. | |

| 251 | Lookup and Reference | EXPAND | Expands or pads an array to specified row and column dimensions. | |

| 252 | Lookup and Reference | FILTER | Filters a range of data based on criteria you define. | |

| 253 | Lookup and Reference | FORMULATEXT | Returns the formula at the given reference as text. | |

| 254 | Lookup and Reference | GETPIVOTDATA | Returns data stored in a PivotTable report. | |

| 255 | Lookup and Reference | GROUPBY | Helps a user group, aggregate, sort, and filter data based on the fields you specify. | |

| 256 | Lookup and Reference | HLOOKUP | Looks in the top row of an array and returns the value of the indicated cell. | |

| 257 | Lookup and Reference | HSTACK | Appends arrays horizontally and in sequence to return a larger array. | |

| 258 | Lookup and Reference | HYPERLINK | Creates a shortcut or jump that opens a document stored on a network server, an intranet, or the Internet. | |

| 259 | Lookup and Reference | IMAGE | urns an image from a given source. | |

| 260 | Lookup and Reference | INDEX | Uses an index to choose a value from a reference or array. | |

| 261 | Lookup and Reference | INDIRECT | Returns a reference indicated by a text value. | |

| 262 | Lookup and Reference | LOOKUP | Looks up values in a vector or array. | |

| 263 | Lookup and Reference | MATCH | Looks up values in a reference or array. | |

| 264 | Lookup and Reference | OFFSET | Returns a reference offset from a given reference. | |

| 265 | Lookup and Reference | PIVOTBY | Helps a user group, aggregate, sort, and filter data based on the row and column fields that you specify. | |

| 266 | Lookup and Reference | ROW | Returns the row number of a reference. | |

| 267 | Lookup and Reference | ROWS | Returns the number of rows in a reference. | |

| 268 | Lookup and Reference | RTD | Retrieves real-time data from a program that supports COM automation. | |

| 269 | Lookup and Reference | SORT | Sorts the contents of a range or array. | |

| 270 | Lookup and Reference | SORTBY | Sorts the contents of a range or array based on the values in a corresponding range or array. | |

| 271 | Lookup and Reference | TAKE | Returns a specified number of contiguous rows or columns from the start or end of an array. | |

| 272 | Lookup and Reference | TOCOL | Returns the array in a single column. | |

| 273 | Lookup and Reference | TOROW | Returns the array in a single row. | |

| 274 | Lookup and Reference | TRANSPOSE | Returns the transpose of an array. | |

| 275 | Lookup and Reference | TRIMRANGE | Scans in from the edges of a range or array until it finds a non-blank cell (or value), it then excludes those blank rows or columns. | |

| 276 | Lookup and Reference | UNIQUE | Returns a list of unique values in a list or range. | |

| 277 | Lookup and Reference | VLOOKUP | Looks in the first column of an array and moves across the row to return the value of a cell. | |

| 278 | Lookup and Reference | XLOOKUP | Searches a range or an array, and returns an item corresponding to the first match it finds. If a match doesn't exist, then XLOOKUP can return the closest (approximate) match. | |

| 279 | Lookup and Reference | XMATCH | Returns the relative position of an item in an array or range of cells. . | |

| 280 | Math and Trigonometry | ABS | Returns the absolute value of a number. | |

| 281 | Math and Trigonometry | ACOS | Returns the arccosine of a number. | |

| 282 | Math and Trigonometry | ACOSH | Returns the inverse hyperbolic cosine of a number. | |

| 283 | Math and Trigonometry | ACOT | Returns the arccotangent of a number. | |

| 284 | Math and Trigonometry | ACOTH | Returns the hyperbolic arccotangent of a number. | |

| 285 | Math and Trigonometry | AGGREGATE | Returns an aggregate in a list or database. | |

| 286 | Math and Trigonometry | ARABIC | Converts a Roman number to Arabic, as a number. | |

| 287 | Math and Trigonometry | ASIN | Returns the arcsine of a number. | |

| 288 | Math and Trigonometry | ASINH | Returns the inverse hyperbolic sine of a number. | |

| 289 | Math and Trigonometry | ATAN | Returns the arctangent of a number. | |

| 290 | Math and Trigonometry | ATAN2 | Returns the arctangent from x- and y-coordinates. | |

| 291 | Math and Trigonometry | ATANH | Returns the inverse hyperbolic tangent of a number. | |

| 292 | Math and Trigonometry | BASE | Converts a number into a text representation with the given radix (base). | |

| 293 | Math and Trigonometry | CEILING.MATH | Rounds a number up, to the nearest integer or to the nearest multiple of significance. | |

| 294 | Math and Trigonometry | CEILING.PRECISE | Rounds a number the nearest integer or to the nearest multiple of significance. Regardless of the sign of the number, the number is rounded up. | |

| 295 | Math and Trigonometry | COMBIN | Returns the number of combinations for a given number of objects. | |

| 296 | Math and Trigonometry | COMBINA | . | |

| 297 | Math and Trigonometry | COS | Returns the cosine of a number. | |

| 298 | Math and Trigonometry | COSH | Returns the hyperbolic cosine of a number. | |

| 299 | Math and Trigonometry | COT | Returns the hyperbolic cosine of a number. | |

| 300 | Math and Trigonometry | COTH | Returns the cotangent of an angle. | |

| 301 | Math and Trigonometry | CSC | Returns the cosecant of an angle. | |

| 302 | Math and Trigonometry | CSCH | Returns the hyperbolic cosecant of an angle. | |

| 303 | Math and Trigonometry | DECIMAL | Converts a text representation of a number in a given base into a decimal number. | |

| 304 | Math and Trigonometry | DEGREES | Converts radians to degrees. | |

| 305 | Math and Trigonometry | EVEN | Rounds a number up to the nearest even integer. | |

| 306 | Math and Trigonometry | EXP | Returns e raised to the power of a given number. | |

| 307 | Math and Trigonometry | FACT | Returns the factorial of a number. | |

| 308 | Math and Trigonometry | FACTDOUBLE | Returns the double factorial of a number. | |

| 309 | Math and Trigonometry | FLOOR.MATH | Rounds a number down, to the nearest integer or to the nearest multiple of significance. | |

| 310 | Math and Trigonometry | FLOOR.PRECISE | Rounds a number the nearest integer or to the nearest multiple of significance. Regardless of the sign of the number, the number is rounded up. | |

| 311 | Math and Trigonometry | GCD | Returns the greatest common divisor. | |

| 312 | Math and Trigonometry | INT | Rounds a number down to the nearest integer. | |

| 313 | Math and Trigonometry | ISO.CEILING | Returns a number that is rounded up to the nearest integer or to the nearest multiple of significance. | |

| 314 | Math and Trigonometry | LCM | Returns the least common multiple. | |

| 315 | Math and Trigonometry | LN | Returns the natural logarithm of a number. | |

| 316 | Math and Trigonometry | LOG | Returns the logarithm of a number to a specified base. | |

| 317 | Math and Trigonometry | LOG10 | Returns the base-10 logarithm of a number. | |

| 318 | Math and Trigonometry | MDETERM | Returns the matrix determinant of an array. | |

| 319 | Math and Trigonometry | MINVERSE | Returns the matrix inverse of an array. | |

| 320 | Math and Trigonometry | MMULT | Returns the matrix product of two arrays. | |

| 321 | Math and Trigonometry | MOD | Returns the remainder from division. | |

| 322 | Math and Trigonometry | MROUND | Returns a number rounded to the desired multiple. | |

| 323 | Math and Trigonometry | MULTINOMIAL | Returns the multinomial of a set of numbers. | |

| 324 | Math and Trigonometry | MUNIT | Returns the unit matrix or the specified dimension. | |

| 325 | Math and Trigonometry | ODD | Rounds a number up to the nearest odd integer. | |

| 326 | Math and Trigonometry | PERCENTOF | Sums the values in the subset and divides it by all the values. | |

| 327 | Math and Trigonometry | PI | Returns the value of pi. | |

| 328 | Math and Trigonometry | POWER | Returns the result of a number raised to a power. | |

| 329 | Math and Trigonometry | PRODUCT | Multiplies its arguments. | |

| 330 | Math and Trigonometry | QUOTIENT | Returns the integer portion of a division. | |

| 331 | Math and Trigonometry | RADIANS | Converts degrees to radians. | |

| 332 | Math and Trigonometry | RAND | Returns a random number between 0 and 1. | |

| 333 | Math and Trigonometry | RANDARRAY | Returns an array of random numbers between 0 and 1. However, you can specify the number of rows and columns to fill, minimum and maximum values, and whether to return whole numbers or decimal values. | |

| 334 | Math and Trigonometry | RANDBETWEEN | Returns a random number between the numbers you specify. | |

| 335 | Math and Trigonometry | ROMAN | Converts an arabic numeral to roman, as text. | |

| 336 | Math and Trigonometry | ROUND | Rounds a number to a specified number of digits. | |

| 337 | Math and Trigonometry | ROUNDDOWN | Rounds a number down, toward zero. | |

| 338 | Math and Trigonometry | ROUNDUP | Rounds a number up, away from zero. | |

| 339 | Math and Trigonometry | SEC | Returns the secant of an angle. | |

| 340 | Math and Trigonometry | SECH | Returns the hyperbolic secant of an angle. | |

| 341 | Math and Trigonometry | SEQUENCE | Generates a list of sequential numbers in an array, such as 1, 2, 3, 4. | |

| 342 | Math and Trigonometry | SERIESSUM | Returns the sum of a power series based on the formula. | |

| 343 | Math and Trigonometry | SIGN | Returns the sign of a number. | |

| 344 | Math and Trigonometry | SIN | Returns the sine of the given angle. | |

| 345 | Math and Trigonometry | SINH | Returns the hyperbolic sine of a number. | |

| 346 | Math and Trigonometry | SQRT | Returns a positive square root. | |

| 347 | Math and Trigonometry | SQRTPI | Returns the square root of (number * pi). | |

| 348 | Math and Trigonometry | SUBTOTAL | Returns a subtotal in a list or database. | |

| 349 | Math and Trigonometry | SUM | Adds its arguments. | |

| 350 | Math and Trigonometry | SUMIF | Adds the cells specified by a given criteria. | |

| 351 | Math and Trigonometry | SUMIFS | Adds the cells in a range that meet multiple criteria. | |

| 352 | Math and Trigonometry | SUMPRODUCT | Returns the sum of the products of corresponding array components. | |

| 353 | Math and Trigonometry | SUMSQ | Returns the sum of the squares of the arguments. | |

| 354 | Math and Trigonometry | SUMX2MY2 | Returns the sum of the difference of squares of corresponding values in two arrays. | |

| 355 | Math and Trigonometry | SUMX2PY2 | Returns the sum of the sum of squares of corresponding values in two arrays. | |

| 356 | Math and Trigonometry | SUMXMY2 | Returns the sum of squares of differences of corresponding values in two arrays. | |

| 357 | Math and Trigonometry | TAN | Returns the tangent of a number. | |

| 358 | Math and Trigonometry | TANH | Returns the hyperbolic tangent of a number. | |

| 359 | Math and Trigonometry | TRUNC | Truncates a number to an integer. | |

| 360 | Returns the number of | Returns the number of combinations with repetitions for a given number of items. | ||

| 361 | Statistical | AVEDEV | Returns the average of the absolute deviations of data points from their mean. | |

| 362 | Statistical | AVERAGE | Returns the average of its arguments. | |

| 363 | Statistical | AVERAGEA | Returns the average of its arguments, including numbers, text, and logical values. | |

| 364 | Statistical | AVERAGEIF | Returns the average (arithmetic mean) of all the cells in a range that meet a given criteria. | |

| 365 | Statistical | AVERAGEIFS | Returns the average (arithmetic mean) of all cells that meet multiple criteria. | |

| 366 | Statistical | BETA.DIST | Returns the beta cumulative distribution function. | |

| 367 | Statistical | BETA.INVn | Returns the inverse of the cumulative distribution function for a specified beta distribution. | |

| 368 | Statistical | BINOM.DIST | Returns the individual term binomial distribution probability. | |

| 369 | Statistical | BINOM.DIST.RANGE | Returns the probability of a trial result using a binomial distribution. | |

| 370 | Statistical | BINOM.INV | Returns the smallest value for which the cumulative binomial distribution is less than or equal to a criterion value. | |

| 371 | Statistical | CHISQ.DIST | Returns the cumulative beta probability density function. | |

| 372 | Statistical | CHISQ.DIST.RT | Returns the one-tailed probability of the chi-squared distribution. | |

| 373 | Statistical | CHISQ.INV | Returns the cumulative beta probability density function. | |

| 374 | Statistical | CHISQ.INV.RT | Returns the inverse of the one-tailed probability of the chi-squared distribution. | |

| 375 | Statistical | CHISQ.TEST | Returns the test for independence. | |

| 376 | Statistical | CONFIDENCE.NORM | Returns the confidence interval for a population mean. | |

| 377 | Statistical | CONFIDENCE.T | Returns the confidence interval for a population mean, using a Student's t distribution. | |

| 378 | Statistical | CORREL | Returns the correlation coefficient between two data sets. | |

| 379 | Statistical | COUNT | Counts how many numbers are in the list of arguments. | |

| 380 | Statistical | COUNTA | Counts how many values are in the list of arguments. | |

| 381 | Statistical | COUNTBLANK | Counts the number of blank cells within a range. | |

| 382 | Statistical | COUNTIF | Counts the number of cells within a range that meet the given criteria. | |

| 383 | Statistical | COUNTIFS | Counts the number of cells within a range that meet multiple criteria. | |

| 384 | Statistical | COVARIANCE.P | Returns covariance, the average of the products of paired deviations. | |

| 385 | Statistical | COVARIANCE.S | Returns the sample covariance, the average of the products deviations for each data point pair in two data sets. | |

| 386 | Statistical | DEVSQ | Returns the sum of squares of deviations. | |

| 387 | Statistical | EXPON.DIST | Returns the exponential distribution. | |

| 388 | Statistical | F.DIST | Returns the F probability distribution. | |

| 389 | Statistical | F.DIST.RT | Returns the F probability distribution. | |

| 390 | Statistical | F.INV | Returns the inverse of the F probability distribution. | |

| 391 | Statistical | F.INV.RT | Returns the inverse of the F probability distribution. | |

| 392 | Statistical | F.TEST | Returns the result of an F-test. | |

| 393 | Statistical | FISHER | Returns the Fisher transformation. | |

| 394 | Statistical | FISHERINV | Returns the inverse of the Fisher transformation. | |

| 395 | Statistical | FORECAST | Returns a value along a linear trend. | |

| 396 | Statistical | FORECAST.ETS | Returns a future value based on existing (historical) values by using the AAA version of the Exponential Smoothing (ETS) algorithm. | |

| 397 | Statistical | FORECAST.ETS.CONFINT | Returns a confidence interval for the forecast value at the specified target date. | |

| 398 | Statistical | FORECAST.ETS.SEASONALITY | Returns the length of the repetitive pattern Excel detects for the specified time series. | |

| 399 | Statistical | FORECAST.ETS.STAT | Returns a statistical value as a result of time series forecasting. | |

| 400 | Statistical | FORECAST.LINEAR | Returns a future value based on existing values. | |

| 401 | Statistical | FREQUENCY | Returns a frequency distribution as a vertical array. | |

| 402 | Statistical | GAMMA | Returns the Gamma function value. | |

| 403 | Statistical | GAMMA.DIST | Returns the gamma distribution. | |

| 404 | Statistical | GAMMA.INV | Returns the inverse of the gamma cumulative distribution. | |

| 405 | Statistical | GAMMALN | Returns the natural logarithm of the gamma function, Γ(x). | |

| 406 | Statistical | GAMMALN.PRECISE | Returns the natural logarithm of the gamma function, Γ(x). | |

| 407 | Statistical | GAUSS | Returns 0.5 less than the standard normal cumulative distribution. | |

| 408 | Statistical | GEOMEAN | Returns the geometric mean. | |

| 409 | Statistical | GROWTH | Returns values along an exponential trend. | |

| 410 | Statistical | HARMEAN | Returns the harmonic mean. | |

| 411 | Statistical | HYPGEOM.DIST | Returns the hypergeometric distribution. | |

| 412 | Statistical | INTERCEPT | Returns the intercept of the linear regression line. | |

| 413 | Statistical | KURT | Returns the kurtosis of a data set. | |

| 414 | Statistical | LARGE | Returns the k-th largest value in a data set. | |

| 415 | Statistical | LINEST | Returns the parameters of a linear trend. | |

| 416 | Statistical | LOGEST | Returns the parameters of an exponential trend. | |

| 417 | Statistical | LOGNORM.DIST | Returns the cumulative lognormal distribution. | |

| 418 | Statistical | LOGNORM.INV | Returns the inverse of the lognormal cumulative distribution. | |

| 419 | Statistical | MAX | Returns the maximum value in a list of arguments. | |

| 420 | Statistical | MAXA | Returns the maximum value in a list of arguments, including numbers, text, and logical values. | |

| 421 | Statistical | MAXIFS | Returns the maximum value among cells specified by a given set of conditions or criteria. | |

| 422 | Statistical | MEDIAN | Returns the median of the given numbers. | |

| 423 | Statistical | MIN | Returns the minimum value in a list of arguments. | |

| 424 | Statistical | MINA | Returns the smallest value in a list of arguments, including numbers, text, and logical values. | |

| 425 | Statistical | MINIFS | Returns the minimum value among cells specified by a given set of conditions or criteria. | |

| 426 | Statistical | MODE.MULT | Returns a vertical array of the most frequently occurring, or repetitive values in an array or range of data. | |

| 427 | Statistical | MODE.SNGL | Returns the most common value in a data set. | |

| 428 | Statistical | NEGBINOM.DIST | Returns the negative binomial distribution. | |

| 429 | Statistical | NORM.DIST | Returns the normal cumulative distribution. | |

| 430 | Statistical | NORM.S.DIST | Returns the standard normal cumulative distribution. | |

| 431 | Statistical | NORM.S.INV | Returns the inverse of the standard normal cumulative distribution. | |

| 432 | Statistical | NORMINV | Returns the inverse of the normal cumulative distribution. | |

| 433 | Statistical | PEARSON | Returns the Pearson product moment correlation coefficient. | |

| 434 | Statistical | PERCENTILE.EXC | Returns the k-th percentile of values in a range, where k is in the range 0.1, exclusive. | |

| 435 | Statistical | PERCENTILE.INC | Returns the k-th percentile of values in a range. | |

| 436 | Statistical | PERCENTRANK.EXC | Returns the rank of a value in a data set as a percentage (0.1, exclusive) of the data set. | |

| 437 | Statistical | PERCENTRANK.INC | Returns the percentage rank of a value in a data set. | |

| 438 | Statistical | PERMUT | Returns the number of permutations for a given number of objects. | |

| 439 | Statistical | PERMUTATIONA | Returns the number of permutations for a given number of objects (with repetitions) that can be selected from the total objects. | |

| 440 | Statistical | PHI | Returns the value of the density function for a standard normal distribution. | |

| 441 | Statistical | POISSON.DIST | Returns the Poisson distribution. | |

| 442 | Statistical | PROB | Returns the probability that values in a range are between two limits. | |

| 443 | Statistical | QUARTILE.EXC | Returns the quartile of the data set, based on percentile values from 0.1, exclusive. | |

| 444 | Statistical | QUARTILE.INC | Returns the quartile of a data set. | |

| 445 | Statistical | RANK.AVG | Returns the rank of a number in a list of numbers. | |

| 446 | Statistical | RANK.EQ | Returns the rank of a number in a list of numbers. | |

| 447 | Statistical | RSQ | Returns the square of the Pearson product moment correlation coefficient. | |

| 448 | Statistical | SKEW | Returns the skewness of a distribution. | |

| 449 | Statistical | SKEW.P | Returns the skewness of a distribution based on a population a characterization of the degree of asymmetry of a distribution around its mean. | |

| 450 | Statistical | SLOPE | Returns the slope of the linear regression line. | |

| 451 | Statistical | SMALL | Returns the k-th smallest value in a data set. | |

| 452 | Statistical | STANDARDIZE | Returns a normalized value. | |

| 453 | Statistical | STDEV.P | Calculates standard deviation based on the entire population. | |

| 454 | Statistical | STDEV.S | Estimates standard deviation based on a sample. | |

| 455 | Statistical | STDEVA | Estimates standard deviation based on a sample, including numbers, text, and logical values. | |

| 456 | Statistical | STDEVPA | Calculates standard deviation based on the entire population, including numbers, text, and logical values. | |

| 457 | Statistical | STEYX | Returns the standard error of the predicted y-value for each x in the regression. | |

| 458 | Statistical | T.DIST | Returns the Percentage Points (probability) for the Student t-distribution. | |

| 459 | Statistical | T.DIST.2T | Returns the Percentage Points (probability) for the Student t-distribution. | |

| 460 | Statistical | T.DIST.RT | Returns the Student's t-distribution. | |

| 461 | Statistical | T.INV | Returns the t-value of the Student's t-distribution as a function of the probability and the degrees of freedom. | |

| 462 | Statistical | T.INV.2T | Returns the inverse of the Student's t-distribution. | |

| 463 | Statistical | T.TEST | Returns the probability associated with a Student's t-test. | |

| 464 | Statistical | TREND | Returns values along a linear trend. | |

| 465 | Statistical | TRIMMEAN | Returns the mean of the interior of a data set. | |

| 466 | Statistical | VAR.P | Calculates variance based on the entire population. | |

| 467 | Statistical | VAR.S | Estimates variance based on a sample. | |

| 468 | Statistical | VARA | Estimates variance based on a sample, including numbers, text, and logical values. | |

| 469 | Statistical | VARPA | Calculates variance based on the entire population, including numbers, text, and logical values. | |

| 470 | Statistical | WEIBULL.DIST | Returns the Weibull distribution. | |

| 471 | Statistical | Z.TEST | Returns the one-tailed probability-value of a z-test. | |

| 472 | Text | ARRAYTOTEXT | Returns an array of text values from any specified range. | |

| 473 | Text | ASC | Changes full-width (double-byte) English letters or katakana within a character string to half-width (single-byte) characters. | |

| 474 | Text | BAHTTEXT | Converts a number to text, using the ß (baht) currency format. | |

| 475 | Text | CHAR | Returns the character specified by the code number. | |

| 476 | Text | CLEAN | Removes all nonprintable characters from text. | |

| 477 | Text | CODE | Returns a numeric code for the first character in a text string. | |

| 478 | Text | CONCAT | Combines the text from multiple ranges and/or strings, but it doesn't provide the delimiter or IgnoreEmpty arguments. | |

| 479 | Text | CONCATENATE | Joins several text items into one text item. | |

| 480 | Text | DBCS | Changes half-width (single-byte) English letters or katakana within a character string to full-width (double-byte) characters. | |

| 481 | Text | DETECTLANGUAGE | Identifies the language of a specified text. | |

| 482 | Text | DOLLAR | Converts a number to text, using the $ (dollar) currency format. | |

| 483 | Text | EXACT | Checks to see if two text values are identical. | |

| 484 | Text | FIND, FINDB | Finds one text value within another (case-sensitive). | |

| 485 | Text | FIXED | Formats a number as text with a fixed number of decimals. | |

| 486 | Text | JIS | Changes half-width (single-byte) characters within a string to full-width (double-byte) characters. | |

| 487 | Text | LEFT, LEFTB | Returns the leftmost characters from a text value. | |

| 488 | Text | LEN, LENB | Returns the number of characters in a text string. | |

| 489 | Text | LOWER | Converts text to lowercase. | |

| 490 | Text | MID, MIDB | Returns a specific number of characters from a text string starting at the position you specify. | |

| 491 | Text | NUMBERVALUE | Converts text to number in a locale-independent manner. | |

| 492 | Text | PHONETIC | Extracts the phonetic (furigana) characters from a text string. | |

| 493 | Text | PROPER | Capitalizes the first letter in each word of a text value. | |

| 494 | Text | REGEXEXTRACT | Extracts strings within the provided text that matches the pattern. | |

| 495 | Text | REGEXREPLACE | Replaces strings within the provided text that matches the pattern with replacement. | |

| 496 | Text | REGEXTEST | Determines whether any part of text matches the pattern. | |

| 497 | Text | REPLACE, REPLACEB | Replaces characters within text. | |

| 498 | Text | REPT | Repeats text a given number of times. | |

| 499 | Text | RIGHT, RIGHTB | Returns the rightmost characters from a text value. | |

| 500 | Text | SEARCH, SEARCHB | Finds one text value within another (not case-sensitive). | |

| 501 | Text | SUBSTITUTE | Substitutes new text for old text in a text string. | |

| 502 | Text | T | Converts its arguments to text. | |

| 503 | Text | TEXT | Formats a number and converts it to text. | |

| 504 | Text | TEXTAFTER | Returns text that occurs after given character or string. | |

| 505 | Text | TEXTBEFORE | Returns text that occurs before a given character or string. | |

| 506 | Text | TEXTJOIN | Combines the text from multiple ranges and/or strings. | |

| 507 | Text | TEXTSPLIT | Splits text strings by using column and row delimiters. | |

| 508 | Text | TRANSLATE | Translates a text from one language to another. | |

| 509 | Text | TRIM | Removes spaces from text. | |

| 510 | Text | UNICHAR | Returns the Unicode character that is references by the given numeric value. | |

| 511 | Text | UNICODE | Returns the number (code point) that corresponds to the first character of the text. | |

| 512 | Text | UPPER | Converts text to uppercase. | |

| 513 | Text | VALUE | Converts a text argument to a number. | |

| 514 | Text | VALUETOTEXT | Returns text from any specified value. | |

| 515 | Web | ENCODEURL | Returns a URL-encoded string. | |

| 516 | Web | FILTERXML | Returns specific data from the XML content by using the specified XPath. | |

| 517 | Web | WEBSERVICE | Returns data from a web service. |

| Uppercase | Lowercase | Name |

|---|---|---|

| Α | α | alpha |

| Β | β | beta |

| Γ | γ | gamma |

| Δ | δ | delta |

| Ε | ε | epsilon |

| Ζ | ζ | zêta |

| Η | η | êta |

| Θ | θ | thêta |

| Ι | ι | iota |

| Κ | κ | kappa |

| Λ | λ | lambda |

| Μ | μ | mu |

| Ν | ν | nu |

| Ξ | ξ | xi |

| Ο | ο | omikron |

| Π | π | pi |

| Ρ | ρ | rho |

| Σ | σ, ς | sigma |

| Τ | τ | tau |

| Υ | υ | upsilon |

| Φ | φ | phi |

| Χ | χ | chi |

| Ψ | ψ | psi |

| Ω | ω | omega |

| Parameter | Description |

|---|---|

| S0 | spot price at inception of the contract (t=0) |

| FP | forward price |

| Rf | annual risk-free rate |

| T | forward contract term (years) |

Mark-to-market is an accounting practice or process that involves adjusting the value of an asset or a liability to reflect its current market value rather than its book value or historical cost. The goal of MTM is to ensure that financial statements reflect the true current value of assets and liabilities as determined by the latest market prices.

In the context of futures contracts, MTM refers to the daily process of revaluing the contract based on the market’s closing price and adjusting the margin accounts of the involved parties accordingly.

Mark-to-market is not limited to futures markets—it also applies to a range of other financial assets, including:

Let’s say a trader enters into a long futures contract on oil with a price of USD 70 per barrel. Here’s how MTM would work:

Each day, the trader’s margin account is adjusted according to the daily change in the contract’s value, ensuring that the position is fully collateralized and reflecting the real-time market value of the contract.

Mark-to-market is an essential process for ensuring that the values of financial contracts, particularly in futures markets, are accurately and transparently reflected based on current market conditions. It helps to manage risk, ensure liquidity, and provide up-to-date financial reporting, all while preventing large-scale losses or defaults. The MTM system of daily settlement and revaluation promotes efficiency and stability in financial markets.

A risk premium is the additional return or yield that an investor requires for taking on the extra risk associated with an investment compared to a risk-free alternative. In other words, it compensates investors for bearing uncertainty or potential losses that come with riskier assets.

The formula for the Risk Premium is generally expressed as the difference between the expected return on a risky asset and the return on a risk-free asset. Here’s the formula:

Risk Premium = Expected Return on Risky Asset − Risk-Free Rate

Where:

Example:

If the expected return on a corporate bond is 6%, and the risk-free rate (say, the return on a 1-year Treasury bond) is 2%, the risk premium would be:

This means that investors require an additional 4% return for taking on the risk of the corporate bond, as compared to the risk-free Treasury bond.

In these cases, the formula follows the same basic structure but is applied to different assets (stocks, corporate bonds, etc.).

The difference between the return on a risky asset and the return on a risk-free asset is the risk premium.

Let’s say the risk-free rate (the return on a 1-year U.S. Treasury bond) is 2%, and you’re considering investing in a corporate bond with a higher risk of default. If the expected return on the corporate bond is 5%, the risk premium for this bond would be 5% – 2% = 3%.

In the context of the Unbiased Expectation Hypothesis, if there were a risk premium in play, long-term interest rates would no longer be an unbiased reflection of future short-term rates. Instead, long-term rates would also incorporate a premium for the risk of holding longer-term securities. This would make the relationship between short-term and long-term rates more complex, as investors would be demanding a premium to compensate for the uncertainty over time.

In summary, the risk premium is a fundamental concept in finance, representing the extra return investors demand to compensate for the risks they assume when investing in assets that are not risk-free.

The formula for the present value with discrete compounding is:

$$PV=\frac{FV}{\left( 1+\frac{r}{n} \right)^{nt}}$$

Where:

This formula calculates the present value of a future cash flow, discounted at an interest rate r, with n compounding periods per year, over a period of t years.

The formula for the present value with continuous compounding is:

$$PV=FV⋅e^{−𝑟𝑡}$$

Where:

This formula calculates the present value of a future cash flow when interest is compounded continuously at a rate r over time t.

The given formula is:

$$F_{0}(T) = S_{0}*(1+r)^T$$

To solve for

, we can follow these steps:

(1) Divide both sides of the equation by

:

$$\frac{F_{0}(T)}{S_{0}} = (1+r)^T$$

(2) Take the natural logarithm (ln) of both sides:

$$ln\left( \frac{F_{0}(T)}{S_{0}} \right) = ln\left( (1+r)^T \right)$$

(3) Use the logarithmic identity

:

$$ln\left( \frac{F_{0}(T)}{S_{0}} \right) = T*ln(1+r)$$

Finally, solve for

by dividing both sides by

:

$$T=\frac{ln\left( \frac{F_{0}(T)}{S_{0}} \right)}{ln(1+r)}$$

So the formula to find T is:

$$T=\frac{ln\left( \frac{F_{0}(T)}{S_{0}} \right)}{ln(1+r)}$$

xxx

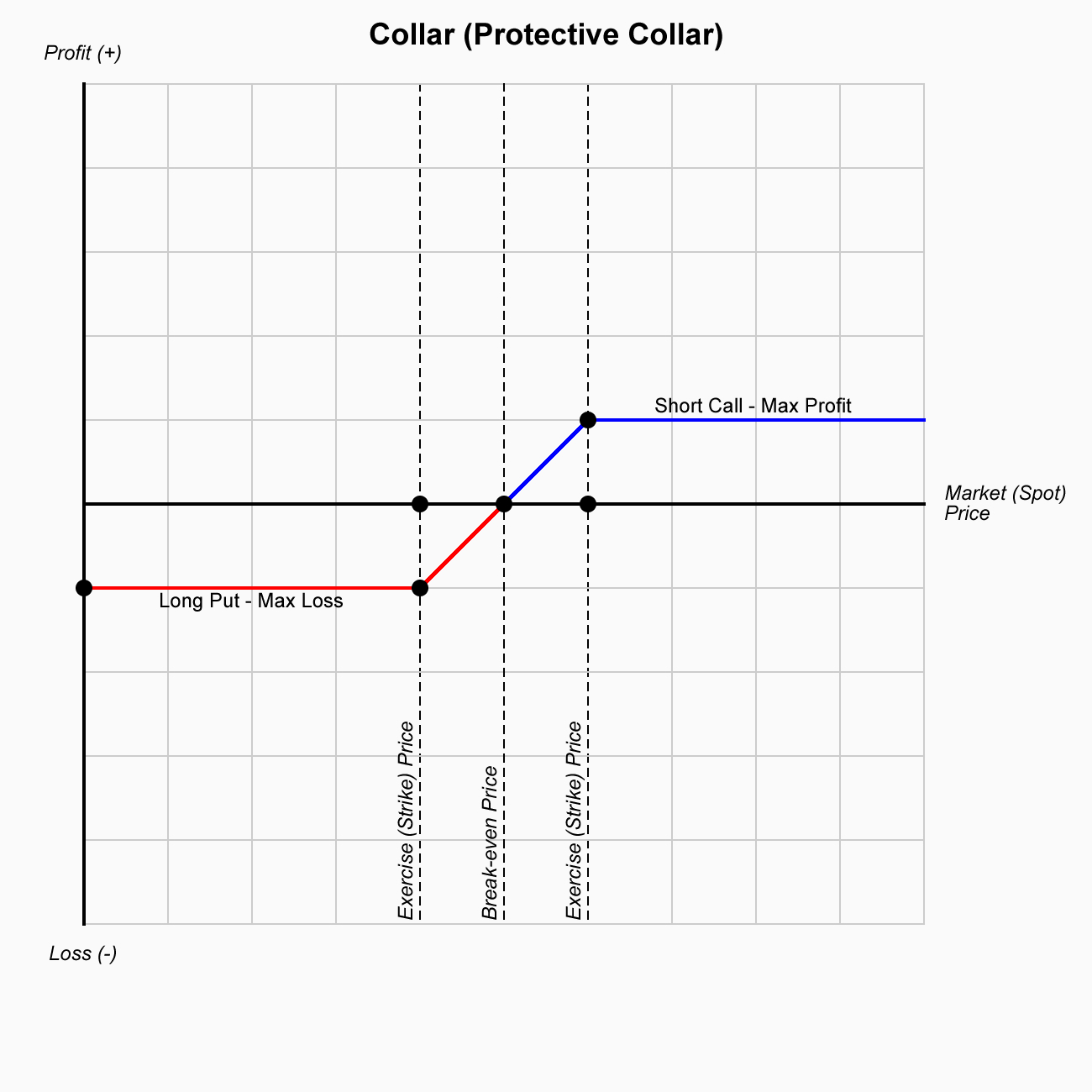

A Collar (also known as a Protective Collar) is a popular options strategy that combines the use of a long position in the underlying asset, a covered call, and a protective put. The purpose of a collar is to limit potential losses on the underlying asset while also capping potential gains. This strategy is often used by investors who want to protect themselves from downside risk, but who are also willing to limit their upside potential in exchange for that protection.

The collar strategy is used to limit downside risk while also capping upside potential. This strategy is suitable for investors who want to protect their gains or limit losses in a volatile or uncertain market but are willing to forgo unlimited potential profits in return for the protection provided by the put option.

The collar strategy typically involves the following steps:

The protective collar limits both potential losses (through the protective put) and potential gains (through the sold call option). The cost of buying the protective put is partially or fully offset by the premium received from selling the call option, making it an affordable risk management strategy for some investors.

Let’s consider an investor who owns 100 shares of a stock currently trading at $50 per share. The investor wants to limit potential losses but also wants to potentially profit from some upside movement. The investor decides to implement a collar strategy by selling a covered call and buying a protective put.

In this case, the investor is using the $200 premium from the covered call to help offset the cost of the $100 premium for the protective put. Therefore, the net cost of the collar strategy is $100 ($200 premium from the call minus $100 cost of the put).

The collar (protective collar) strategy is a risk management tool that allows investors to protect against downside risk while capping potential upside gain. By combining a long position in the asset, selling a covered call, and buying a protective put, the collar provides a defined risk/reward profile. This strategy is useful for investors looking to hedge their positions in volatile markets, protect gains, or generate income through options premiums, while also being willing to limit potential profits. The strategy works well in markets with uncertainty or volatility and is especially attractive to investors with neutral to slightly bullish outlooks.