Holding Period Return (HPR) is a measure of the total return on an investment over a specific period of time, regardless of whether the investment is held for a short or long duration. It takes into account both income earned from the investment (such as dividends or interest) and capital gains or losses due to price changes during the holding period.

HPR is particularly useful for assessing the performance of an investment over a discrete time period, like a year, month, or any other specified time frame. It’s often used in investment analysis to compare the performance of different assets, portfolios, or investment strategies.

The basic formula for calculating the Holding Period Return (HPR) is:

Where:

Example 1: Stock Investment with Dividends

Suppose an investor buys 100 shares of a stock for $50 per share at the beginning of the year. During the year, the stock pays $2 per share in dividends, and by the end of the year, the stock price rises to $60 per share.

Now, plug the values into the HPR formula:

In this case, the Holding Period Return is 24%, meaning the investor achieved a 24% return on the investment over the year, considering both capital appreciation and dividends.

Example 2: Bond Investment with Interest

Let’s assume an investor purchases a bond for $1,000. Over the next year, the bond pays $50 in interest (coupon payment), and the price of the bond rises to $1,050.

Now, apply the HPR formula:

In this case, the Holding Period Return is 10%.

The Holding Period Return is widely used for several reasons:

When an investment is held for less than or more than a year, it is common to annualize the holding period return to make it comparable to annualized returns from other investments. The annualization process adjusts the return to reflect a full year, assuming the investment’s performance over the holding period would continue at the same rate.

To annualize a return, you can use the following formula:

Where:

Example: Annualizing a Six-Month Return

Let’s say an investor has a holding period return of 10% for an investment held for 6 months. To annualize the return, use the formula:

In this example, the annualized holding period return is 21%, assuming the same performance would continue for the full year.

While HPR is a useful measure, it has some limitations:

HPR is often used in the following scenarios:

The Holding Period Return (HPR) is an essential metric for measuring the total return of an investment over a specific period. By including both income and capital gains or losses, HPR provides a comprehensive picture of an investment’s performance. While HPR is a simple and effective tool for performance assessment, investors should be aware of its limitations, including its lack of consideration for compounding, risk, and transaction costs. Annualizing the return can make it more comparable to other investments held over different periods. HPR remains a fundamental calculation for comparing the performance of various assets and for evaluating the success of investment strategies.

$$\begin{aligned} HPR\; &= \left [ Final\;Price\;-\;Original\;Price\;+\;Income \over Original\;Price \right ] \\\\ &= \;\left [ Capital\;Gain\;+\;Dividends \over Original\;Price \right ] \end{aligned}$$

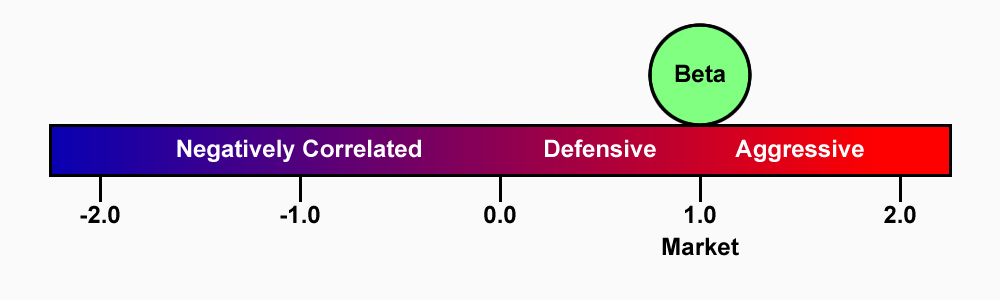

The Beta Coefficient measures the volatility of a particular share (systematic risk) in comparison to the market (unsystematic risk). It describes the sensitivity of a security’s returns in response to swings in the market.

Systematic risk is the underlying risk that affects the entire market. Large changes in macroeconomic variables, such as interest rates, inflation, GDP, or foreign exchange, are changes that impact the broader market and that cannot be avoided through diversification. The Beta coefficient relates ‘the market’ systematic risk to ‘stock-specific’ unsystematic risk by comparing the rate of change between ‘the market’ and ‘stock-specific’ returns.

Statistically, beta represents the slope of the line through a regression of data points from an individual stock’s returns against those of the market.

The beta calculation is used to help investors understand whether a stock moves in the same direction as the rest of the market, and how volatile or risky it is compared to the market.

For beta to provide any insight, the ‘market’ used as a benchmark should be related to the stock.

For example, calculating a bond ETF’s beta by using the S&P 500 as the benchmark isn’t helpful because bonds and stocks are too dissimilar. The benchmark or market return used in the calculation needs to be related to the stock because an investor is trying to gauge how much risk a stock is adding to a portfolio.

A stock that deviates very little from the market doesn’t add a lot of risk to a portfolio, but it also doesn’t increase the theoretical potential for greater returns.

The beta of the market portfolio is always 1.0

$$ Beta\;Coefficient\;(β) = \left [Covariance (rp, rb) \over Variance (rb) \right ]$$

The Sharpe Ratio is a widely used measure to assess the risk-adjusted return of an investment or portfolio. It helps investors understand how well the return of an asset compensates for the risk taken to achieve that return. The Sharpe Ratio is named after William F. Sharpe, who developed it in 1966.

The Sharpe Ratio allows investors to evaluate whether an investment’s returns are due to smart investment decisions or excessive risk-taking. A higher Sharpe Ratio indicates better risk-adjusted returns, meaning the investor is receiving more return per unit of risk. Conversely, a lower Sharpe Ratio suggests that the return isn’t compensating the investor adequately for the level of risk being taken.

The Sharpe Ratio is calculated as:

Where:

= Sharpe Ratio

= Return of the portfolio or investment (often the expected return or the actual return over a specific period)

= Risk-free rate (the return on a risk-free investment, typically a government bond like U.S. Treasuries)

= Standard deviation of the portfolio’s returns, a measure of risk (volatility)

:

:

Example

Let’s say you have the following data:

): 10% (0.10)

): 2% (0.02)

): 15% (0.15)

The Sharpe Ratio would be calculated as:

This means the Sharpe Ratio for this investment is 0.533, which indicates that the investment provides less return than its risk would ideally warrant (i.e., the risk-adjusted return is moderate).

The Sharpe Ratio is a valuable tool for investors to assess the return on an investment relative to the risk taken. A higher Sharpe Ratio indicates a more favorable risk-adjusted return, while a lower ratio suggests the investment is not compensating adequately for the risk. However, it’s important to be aware of its limitations and use it in conjunction with other metrics to get a more complete picture of an investment’s risk and return characteristics.

$$\begin{aligned} Sharpe\;Ratio &= \left[ Expected\;Return\;-\;Risk\;Free\;Rate\over Standard\;Deviation\;of\;Excess\;Return \right] \\\\\\\ &= \left[ Risk\;Premium\over Standard\;Deviation\;of\;Excess\;Return \right] \\\\\\\ &= \left [E(r_i)\;-\;r_f \over \sigma_i \right]\end{aligned}$$