(Last Updated: 01/07/2020)

| Term | Description |

|---|---|

| Hedging: | A risk management strategy to decrease the risk of investment losses by taking a position in a another asset. |

| Speculation: | Buying an asset expecting the price to increase. |

| Arbitrage: | The buying and selling or two financial assets simultaneously to capitalise on the difference in their prices. |

Step 1: Collect and assess the financial data of the client.

Step 2: Determine the goals and objectives of the client.

Step 3: Analyse the client’s needs and identify any financial problems in strategy formulation.

Step 4: Structuring the Statement of Advice (SOA).

Step 5: Recommendations and implementations.

Step 6: Review and monitor.

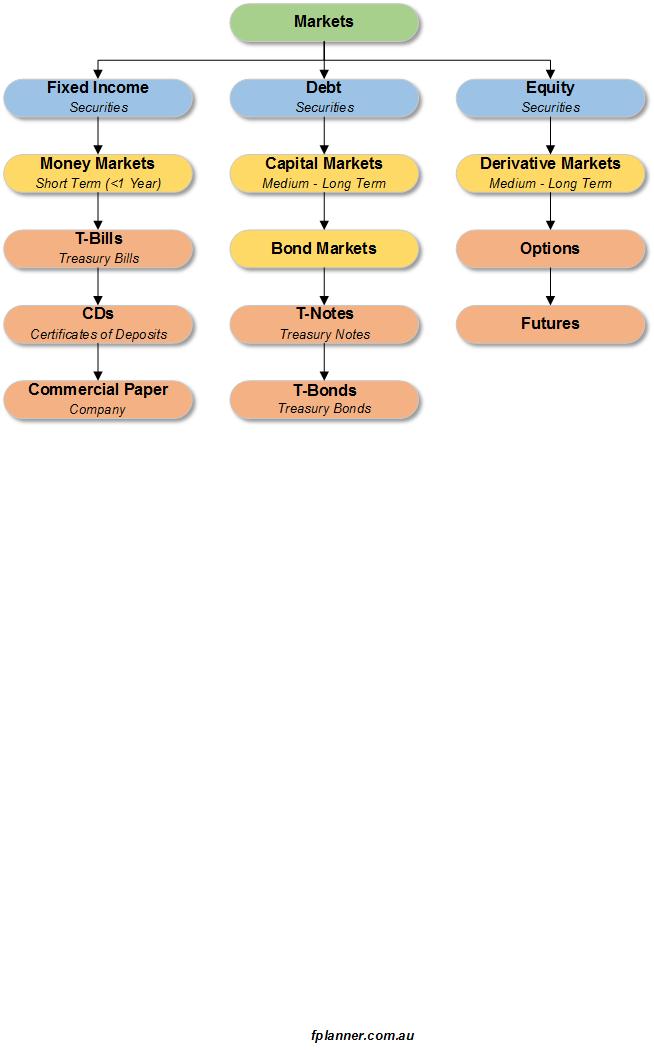

Issued By: Government

Market: Money

Term: Medium to Long (>1 Year)

Type: Discount Security

Liquidity: High

Risk: Low

Securities:

>>>

>>>